It is necessary that the officials who deal with the provisions of Sec. 17 of the ESI Act, 1948 (as amended), keep in view the sea change that was effected in the year 1989 in the administrative matters of the ESI Corporation after the crucial amendment made in the year 1989 to Sec. 17 (2) of the ESI Act, 1948, through Act 29 of 1989.

2. Sec. 17 (2) as was obtaining up to October 1989 is given below:

“(2) The Corporation shall, with the approval of the Central Government, make regulations regarding the method of recruitment, pay and allowances, discipline, superannuation benefits and other conditions of service of the members of its staff.”

This Sec. 17 (2) of the ESI Act, as was in force up to October 1989, enabled and empowered the Corporation to frame independent Recruitment Regulations regarding (a) the method of recruitment, (b) pay and allowances, (c) disciplinary rules, (d) superannuation benefits and (e) other conditions of service, of the members of its staff, as the Corporation deemed fit, subject only to the condition that it had to obtain the prior approval of the Central Government for enforcing those regulations.

3. The ‘method of recruitment’ included ‘Promotion’ too, as could be seen from the Recruitment Rules/Regulations of various posts in every Central Government organisation.

4. As the Corporation could decide on its own formula for recruitment and pay and allowances, as empowered by the wordings in the then existing Sec. 17 (2), quoted supra, there emerged the lobbying culture of the employees of the ESIC through their Union. And the management yielded too.

5. The employees of the ESI Corporation were, consequently, getting many facilities, including enhanced HRA, which was 5% more than what was being given to the Central Government employees. They were getting impressive leave encashment facility of 30 days every year, without actually going on leave, which was not given to the Central Government employees then. It was called as a “facility”.

6. And they kept on demanding more. There was a constant and consistent pressure for an independent pay structure to the employees of the ESIC, like those obtaining then in the LIC and the banking sector. All such demands could be raised by them, then, only because of the then existing Sec. 17 (2) which did not, literally, put any cap on the benefits payable. What was required as per the then prevailing Sec. 17 (2), was that “the approval of the Central Government”, was required to be obtained, only whin Regulations are made, like the Recruitment Regulations, ESIC (Staff & Conditions of Service)Regulations, etc., No such approval was insisted for extending every single service benefit that is extended to the Central Government servants, when they fall within the major head called Regulations.

7. As a result, the management of the ESIC had to go through a separate motion of considering and formally adopting the instructions of the DoPT and the DoP&PW, whenever new orders on service matters were issued by those departments and some service benefits extended to the Central Government employees. That procedure was followed even when Pay Commission’s recommendations were implemented, although the ESIC employees were not permitted to represent before the Pay Commissions.

8. It is worth noting to quote at this juncture that there was a high-power committee set up in the early 1960s under the Chairmanship of the then Central Labour Commissioner and its report was made available in the form of a book. That Committee had considered the nature of qualification required for various posts in the ESIC, duties, responsibilities of various posts and compared them with various posts in the Central Government Departments to decide the corresponding category of posts in the ESIC. That Committee had, significantly arrived at the decision that the post of Insurance Inspector in the ESIC was carrying more responsibilities than the post of Income Tax Inspectors, CBI Inspectors and Excise Inspectors. That was true. And the report of that Committee had been cited in the case filed by the then ESIC Officers Association in the later 1990s before the Hon’ble Central Administrative Tribunal at Jabalpur, when the then Director (Administration) caused an amendment to the Recruitment Regulations of the Insurance Inspectors and reduced the stature of that post.(These details must be available in the relevant case file of the Hqrs. Office or can be ascertained from the Hon’ble CAT, Jabalpur, if the copies of the pleadings are obtained.) Until then, the ESI Insurance Inspectors were drawing pay on a scale higher than those of the CBI Inspectors, Income Tax Inspectors and Excise Inspectors. It happened that a CBI Inspector applied to ESIC, passed the examination and become Insurance Inspector in the ESIC.

9. That comparison apart, when the earlier Sec. 17 (2) mentioned supra was prevailing up to 1989, as a matter of practice, whenever some benefits were extended by the Central Government to its employees, the ESIC management would take a decision, on record, whether it would or would not extend those benefits to its employees, or whether it would extend the same benefits or increase or decrease those benefits. And that process was called, in the official parlance within the organisation, as the process of ‘adoption’ of central government’s orders.

10. The management soon found that that leeway given in the Act to modify the benefits posed a lot of administrative problems to the Secretary of the MoLE, as he had to balance the interests of the employees of the ESI Corporation and his own employees in the Ministry, who were grudgingly watching the ongoings in the ESIC. The officers and the employee of the MoLE were, on many occasions, trying to undermine the autonomous nature of the ESIC, a Central Autonomous Body and a Statutory Body. (Note: There are many Central Autonomous Bodies which are not Statutory Bodies).

11. When the ESIC employees’ union got recognition as Trade Union, things became worse for the Management. The demands from the employees union in the Corporation became never-ending. The Director Generals of the ESI Corporation thought it necessary to put a stop to such unending demands from the unions. They worked on it and brought in an amendment through Act 29 of 1989. The amended provisions of Sec. 17 (2), which were brought into force in October 1989 read as under:

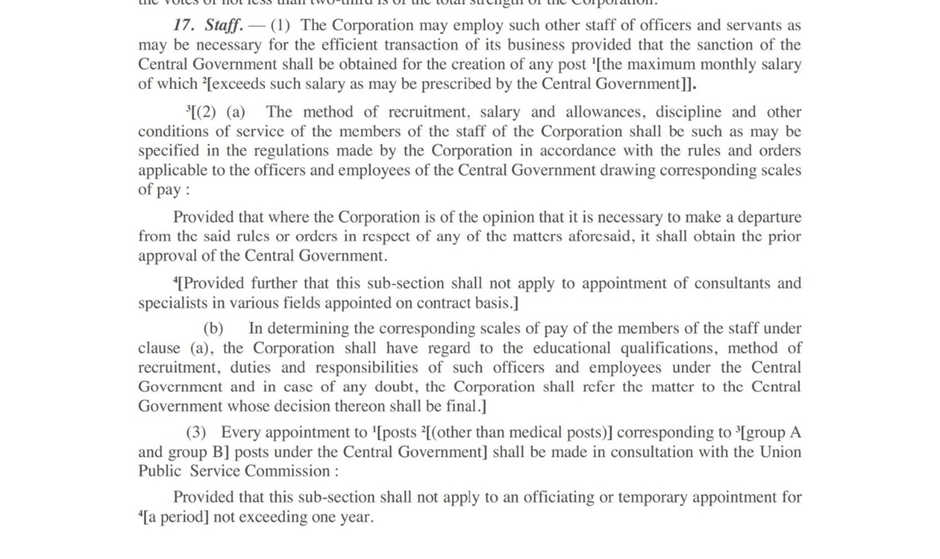

“(2) (a) The method of recruitment, salary and allowances, discipline and other conditions of service of the members of the staff of the Corporation shall be such as may be specified in the regulations made by the Corporation in accordance with the rules and orders applicable to the officers and employees of the Central Government drawing corresponding scales of pay:

Provided that where the Corporation is of the opinion that it is necessary to make a departure from the said rules or orders in respect of any of the matters aforesaid, it shall obtain the prior approval of the Central Government.

(b) In determining the corresponding scales of pay of the members of the staff under clause (a), the Corporation shall have regard to the educational qualifications, method of recruitment, duties and responsibilities of such officers and employees under the Central Government and in case of any doubt, the Corporation shall refer the matter to the Central Government whose decision thereon shall be final.”

This amended provision ensured that the employees of the ESI Corporation would get only what their counterparts in the corresponding category in the Central Government would get and nothing more and nothing less. That was a cap invented by them, introduced through the Amendment and enforced from October 1989 onwards. With that the process of Adoption became unnecessary and was stopped, because Sec. 17 (2) of the ESI Act mandated that the employees of the ESIC, a Statutory Body, would be entitled to get all that is granted to the central government servants of the corresponding category.

12. These amended provisions provided a categorical and clear parameter for comparison and contrast, whenever the ESIC Management wanted to take decision on the method of recruitment (including promotion) of his employees and their pay and allowances and conditions of service. Many a benefit given earlier were put an end to, as they were not given to the employees of the corresponding category in the Central Government. Whenever new orders were issued by the DoPT or the DoP&PW, the decision-making-process became easier for the Administration Branch which had just to compare the issues pertaining to the employees of the ESI Corporation with the employees of the “corresponding” category under the Central Government and decide to go by what the Central Government was providing to the corresponding category. How to decide that “corresponding” category had also been provided in the amended and newly inserted Sec. 17 (2) (b), given supra.

13. The MoLE need not, therefore, entertain any doubt about the applicability of the DoP&PW, O.M. dated 17.02.2020 and 03.03.2023 to the employees of the ESI Corporation.The aforesaid amendment to Sec. 17(2) gave the positive assurance to the employees of the ESI Corporation that they would get whatever the employees of the corresponding category in the Central Government would get. It did not, however, restrain the Management of the ESIC from paying more or less but imposed a pre-condition that if it wanted to make a departure and pay more or pay less or to deviate from a certain mode of recruitment followed in the Central Government for the employees with ‘corresponding scales of pay’, it should obtain prior approval of the Central Government for it, as mandated in the proviso to Sec. 17 (2) (a). This is the law in force as on date. And that cannot be an arbitrary decision.

14. In regard to the medical personnel in the ESI Corporation, the Ministry of Health had made the medical posts in the ESI Corporation also as part of the CHS, as per the CHS Rules, 1963. There had later been the famous Tikku Committee report and documents enabling the medical officers in the ESIC also to get the same benefits as given to the medical officers of the Central Government.

15. Hon’ble Supreme Court had, while examining a different issue, recorded in its order dated 21.11.2013, in ESIC Medical Officers’ Association Vs. ESI Corporation (SLP (C) No. 35821 of 2013), the fact that “The Corporation in the year 1974 set up its own ESIC Medical Centre and under its regulations, the medical doctors recruited in the said medical centre were entitled to the same pay and allowances as admissible to medical doctors in the Central Government Health Services.” (Para 6).

16. The service benefits of the engineers in the ESIC are with reference to the corresponding category of engineers in the CPWD, although the ESIC does not have all the grades of engineers as the CPWD does. This is in accordance with Sec. 17 (2) (a) and Sec. Sec. 17 (2) (b) of the ESI Act amended in 1989.

17. The service benefits of the Hindi Officers in the ESIC are regulated in accordance with those available in the Department of Official Language under the Central Government. This is in accordance with Sec. 17 (2) (a) and Sec. Sec. 17 (2) (b) of the ESI Act amended in 1989.

18. The service benefits of the stenographer hierarchy are regulated in accordance with those available in the CSSS, the Central Secretariat Stenographers Service, although there is no Principal Staff Officer or the Senior Principal Private Secretary in the ESI Corporation, while there are officers of that grade under CSSS. This is in accordance with Sec. 17 (2) (a) and Sec. Sec. 17 (2) (b) of the ESI Act amended in 1989.

19. The service benefits of the Public Relations Officer in the ESI Corporation are being given on par with the officials of the corresponding category in the Indian Information Service in the PIB, although there is only one officer in the cadre of PRO in the ESI Corporation. This is in accordance with Sec. 17 (2) (a) and Sec. Sec. 17 (2) (b) of the ESI Act amended in 1989.

20. The argument of the MoLE regarding ‘adoption’ of government orders, selectively, became irrelevant, after October 1989.

21. The ESIC Management which extended to the medical officers of the ESI Corporation, the allowances like Annual Allowance and Post Graduate Allowance, as could be seen from his letter No. A-28/12/1/2009-Med.IV (Pay & All.) dated 25.05.2018 on par with the provisions of the CHS can convince the MoLE that the employees of the ESIC are entitled to the benefits of the DoP&PW, O.M. dated 17.02.2020 and 03.03.2023, automatically.

22. The essential fact was that that Bill for that amendment of the Parent Act in 1989 had been introduced by the Ministry of Labour in the Parliament, then, only after obtaining the required financial concurrence from the Ministry of Finance, as could be seen from the Financial Memorandum placed along with the Bill concerned.