05.06.2020

To

The Director General,

Hqrs. Office,

ESI Corporation,

New Delhi 110002.

| Sub: | Undermining the basic concept of social security – through definition of the terms ‘employee’ and ‘wages’ – Clause 2 (26) and Clause 2 (80) of the Code on Social Security, 2019 (Bill No. 375 of 2019 in the Lok Sabha) – representation – submitted.

|

| Ref: | 1. The Legal notice sent by me on 25.05.2020.

2. Email dated 29.05.2020 sent from the Wage Cell of the Ministry of Labour & Employment to the Director General, ESI Corporation, New Delhi. |

Sir,

1 . I invite your kind attention to the references cited. I submit that the Ministry of Labour has, in the reference second cited, requested for the views of the Hqrs. Office of the ESI Corporation on the issue of wrong equation of the definition of the term ‘wages’ given in Sec. 2 (y) of the Code on Wages, 2019 with the definition of the term ‘wages’ given in the Clause 2 (80) of the Bill on the Code on Social Security, 2019 (Bill No. 375 of 2019) which has been tabled on the Lok Sabha.

Successful Economy presupposes Successful Social Security:

2 . Historically, right from the day when the Royal Labour Commission had undertaken tour in the year 1929 (after the enforcement of the Workman’s Compensation Act, 1923) to study the living conditions of Indian Labour, the employers had been resisting labour welfare measures, as they were under the popular impression (popular among themselves) that the such measures would be increasing their overheads and that they could not compete in the world market. A ‘successful economy’ cannot be built without ‘successful social security’. Both are intricately intertwined, as has been demonstrated by West Germany during the period between 1945 (when Germany was defeated in the WW II) and 1971 (when its DM attained full value). Franklin D. Roosevelt has gone on record having said, at the time of signing the Social Security Act, on 14th August, 1935, that Act was, “in short, a law that will take care of human needs and at the same time provide the United States an economic structure of vastly greater soundness.”

3. “Willing participation of labour” can be obtained only through social security as observed by the Sir William Beveridge in his monumental report presented in November, 1942. Indian social security system was modelled on the report of Beveridge by Prof. Adharkar. Such willing participation would not be there if the benefits provided at the time of contingencies like sickness, accident, maternity, etc., are not really meaningful and substantial to enable the workers to sustain themselves. That was the precise reason that the term ‘wages’ under Sec. 2 (22) had been so defined in the original Act that it was not only the fixed components but also the variable components would be taken into account for determining the recovery of contribution from the employers and to pay benefits to the employees.

Inspections were meant to confirm contribution on real wages and detect concealed employment:

4. I submit that the present opportunity extended by the Ministry of Labour to examine the issue may kindly be made use of and the spirit of the definition under Sec. 2 (22) of the ESI Act,1948 maintained and those provisions retained. This is all the more essential in the context of downplaying the real importance of inspection of records of the employers to ensure proper compliance. “You don’t get what you expect. You get only what you inspect”. This is what the IAS officers are taught too at Mussorie. But the recent labour legislations are to the contrary and the result is that the workers remain uncared for.

5. Proper and in-depth inspections alone can ensure that all the coverable employees have been covered without being left out, and that contributions are paid on their behalf on all items of wages. Simply expecting that the employers would pay contribution on all items on which it is payable, just because there is a law to that effect would not work. All the officers from the level of Insurance Inspectors (later SSOs) to the level of Deputy Directors of the ESI Corporation, who had attentively handled the subject would provide numerous evidences of the manner in which the employers tried to play with the term ‘wages’ to pay contribution on reduced amount of wages which would, in turn, result in reduced quantum of benefits to the employees facing contingencies. (More in this regard in the Appendix).

6. It is, therefore, necessary to maintain the difference in the definition of the term ‘wages’ which was conceived of in the year 1948 itself, at the time of enactment of both the Acts, the Minimum Wages Act, 1948 and the ESI Act, 1948. There cannot, therefore, be one and the same definition of the term ‘wages’ for both enactments, the Code on Wages, 2019 and the Code on Social Security, 2019.

ESI Wage Ceiling was on par with the salary of Group ‘A’ Officers:

7. Already because of the weakness of the politcians-in-power to yield to the pressure from the lobby of the employers, the ‘wage ceiling’ under the ESI Act was not kept at the appropriate original stage, especially after 1975. There was a lot of resistance from the employers to revise the wage ceiling for coverage under the ESI Act, periodically, on par with the Consumer Price Index. The ESI Scheme had, in the process, lost its original direction and, thereby, its purpose too, to cover a large section of the middle-level income earners among the Indian population. Consequently, the ESI scheme could not extend its coverage to other classes of establishments, although a provision had, thoughtfully, been made for it under Sec. 1 (5) of the ESI Act.

8. It is, therefore, necessary to examine the issues under Sec. 2 (9) of the ESI Act also while examining the impact of Sec. 2 (22) as both are inter-twined. In the context, I would like to submit a few facts for your kind consideration:

a. When the ESI Act was enacted in the year 1948, the wage ceiling for the purpose of coverage was Rs. 400 pm excluding overtime allowances, as per the proviso to Sec. 2 (9) of the Act. At that time, the total salary of a District Collector was less than that. “A princely sum of Rs. 350 was what used to be the total salary of an IAS (ICS) officer at the start of his services in 1949”. It would show that the framers of the Act conceived of the extension of social-security-net not just to the ‘downtrodden’ but to the well-enlightened and well-paid employees too.

b. In the year 1966, this wage ceiling was increased to Rs. 500 pm (excluding overtime allowance), through a formal amendment to the Act, by the Parliament of India. At that time, the Basic Pay for a new entrant IAS officer in the Junior Scale was Rs. 400 pm in the scale of Rs. 400-400-500-40-700-EB-30-1000 (Ref: Page 109 – Chapter 11 – All India Services – Report of the Third Central Pay Commission – Vol I – Published by the Ministry of Finance, Government of India). A new entrant IAS officer was drawing a total salary of less than Rs. 500 pm in a ‘C’ class of the city.

c. Another relevant and interesting fact in this regard was that as per Sec. 17 (1) of the original ESI Act, permission of the Central Government was required to be obtained by the ESI Corporation, only for the creation the posts which carried the pay scale, the maximum of which was Rs. 500. This figure of Rs. 500 in the year 1948 which was the maximum of the required pay scale for such creation of posts would amply illustrate the importance of the wage ceiling of Rs. 400 pm, at that time, (excluding over time allowance) prescribed for coverage of employees in the factories and establishments. That was the then-intended reach of the ESI Act. (Later this provision has been shifted to subordinate legislation, through an amendment in the year 1975, and now such a permission of the Central Government is sought only for the posts in NFSG as per Rule 20 of the ESI (General) Rules, 1950. )

d. In the year 1975, the wage ceiling for coverage was increased to Rs. 1000 pm, through another formal amendment, by the Parliament of India. At that time, the Third Pay Commission had given its report, according to which the Pay Scale of Income Tax Inspector was 425-700. The Customs Inspector was also drawing in the same scale of 425-700. Thus, when the ESI Act was amended in the year 1975 increasing the wage ceiling to Rs.1000 pm (excluding over time allowance), a new entrant Income Tax Inspector was drawing around Rs. 500 pm only as his total salary in a C class city. A new entrant Class I officer, like the Deputy Director in the ESI Corporation or the Assistant Provident Fund Commissioner in the EPF Organisation then, was drawing less than Rs. 1000 pm as his total salary, as his Scale of Pay was only Rs. 700 – 1300, after the enforcement of the Third Pay Commission Report.

e. Given the above scenario, the impact of coverage of the employees in the factories and establishments drawing wages up to Rs. 1000 (excluding over time allowance) could be easily understood. On numerous occasions, during the personal hearings afforded to employers as per Sec. 45 (A) of the ESI Act, 1948, the Deputy Directors of the ESI Corporation had to encounter the employer’s staff members who were drawing more than the Deputy Directors of the ESI Corporation. It was only in the year 1982 that the salary of the Income Tax Inspectors in the ‘C’ class cities crossed the limit of Rs. 1000 pm, and started overtaking the wage ceiling prescribed under the ESI Act for the coverage of the Insured Persons, which continued to remain at Rs. 1000 (excluding over time allowance).

f. In the year 1984 the wage ceiling was increased to Rs. 1600 pm under Sec. 2 (9), excluding over time allowances. But, soon, as per the Fourth Pay Commission recommendations, from 01.01.1986 onwards, the Pay Scale of the Income Tax Inspectors overtook, again, the wage ceiling prescribed under the ESI Act. The Pay Scale of the Income Tax Inspectors was increased to Rs. 1640-2900 and the salary of the Deputy Directors in the ESI Corporation and the Assistant Provident Fund Commissioners in the EPFO were fixed in the Pay Scale of 2200-4000.

g. Thereafter, the wage ceiling for coverage of insured persons under the ESI Act was not increased at any time on the pattern of the increase made earlier through amendments made to the ESI Act in the year 1966 or 1975, to keep within coverage the insured persons who were drawing wages on par with the salary of the central governments at the middle management level in the Central Civil Service, let alone the position conceived of in 1948 to keep within coverage all those drawing wages even above the salary of the District Collectors.

h .The initial salary of a District Collector now in a ‘C’ class city with a Grade Pay of Rs. 8700, the salary of a new entrant Income Tax Inspector with a Grade Pay of Rs. 4600 and the salary of the APFC with a Grade Pay of Rs. 5400, at present, are far above the wage ceiling of Rs. 21000 presently fixed for coverage of employees under the ESI Act. It is only the salary of the MTS, whose cadre is the lowest point of entry into Central Civil Service ranges from 18000 to 20000 now and is below the wage ceiling of Rs. 21000 pm (excluding over time allowance) prescribed under the ESI Act for coverage of insured persons working in factories and establishments.

I submit that the aforesaid facts would convince everyone how the enlightened section of the employees of the factories and establishments were silently made to keep themselves away, in phases, from the ESIC and from having active participation in monitoring the functioning of the ESI Scheme.

9. The employees’ representatives in the supreme body of the organisation could not get better feedback from such enlightened well-paid employees of the factories and establishments. They, in turn, could not represent the cases of the employees before the the ESIC administration, especially about the medical benefits provided by various state governments, especially the state governments of Bihar, MP, Rajasthan, and UP.

10. A social security scheme, which was originally intended to cover not only the so-called ‘blue-collared workers’ but also the ‘white-collared employees’ was, thus, made to leave out the white-collared employees in bulk during the course of just three decades from 1952. It is significant to point out at this juncture that in the year 1947 when the Bill was prepared, it was called only as “Workman’s State Insurance Bill” on the lines of the Workman’s Compensation Act, 1923. But its name was changed later as “Employees’ State Insurance Bill” considering the extent of its intended reach.

Social Security a ‘service’ not a ‘business’:

11. It is submitted that if the present definition of the term ‘wages’ as per Clause 2 (80) and the definition of the term ‘employee’ as per Clause 2 (26) of the present Bill on the Code on Social Security is made law, the coverage of employees for the purpose of providing social security benefit would not only be infinitesimal but also insignificant. Providing Social Security to the people of the nation, which is a ‘Service’ to be provided by the sovereign government, will get converted by the aforesaid two definitions into ‘business’ by and for the private ultra-rich.

No proper study for Social Impact Assessment:

12. All these modifications have, apparently, been done without conducting any study on the Social Impact on the Indian society. It is submitted that the report of the Second National Commission of Labour cannot be cited as a ruse for these micro level changes which would are intended to have far-reaching deleterious effect on the Indian society as a whole. It is a fact that the Second National Labour Commission did not say anything about drafting a labour law, a Social Security Code, to facilitate handing over the ESIC Medical Colleges along with major hospitals to ‘any person’ or any ‘organisation of persons’, by inserting such questionable phrases as has been recorded in Clause 41(5) of the draft Code dated 17.09.2019 and Clause 39(5) of the Bill 375 of 2019 respectively.

West Bengal ESI Hospitals well-run and incentive grant provided:

13. It is submitted that providing social security to the working population is a sovereign function of the State just like running the nation through Revenue Departments or maintaining law and order through Police Department and administering justice through Courts of Law. Just because there is deterioration in services in certain pockets because of the corrupt politician-bureaucrat nexus, as is said to be there in Revenue Department and Police Department or the political interference said to be there in the Judiciary, there is no proposal coming up from any quarters to dispense with these departments or institutions but to insulate them from corruption and political interference. The concept of the ESI Scheme cannot also be derided and attempted to be dispensed with, for the very same reason. Experience has demonstrated, on many occasions, that the ESIC could be run finer and could be run corruption-free, when there is no political interference in the administration of the organization. The Scandinavian countries top the Human Development Index consistently for long, only because the organizations which provide social security benefits there are run corruption-free.

14. The Chief Minister of West Bengal had said, “The excellent performance of the ESI Hospitals in West Bengal run by our labour department has been recognized by the Centre. An incentive grant of Rs 22.33 crore has been provided, which is first time ever to be received by any ESI Hospital in the country,” (Times of India 09.11.2014).

Judiciary wanted to impose costs on the draftsmen and the legislators:

15. Lord Justice Scrutton observed the following in Roe vs. Russel (1928) :“I regret that I cannot order the costs to be paid by the draftsmen of the Rent Restriction Acts, and the members of the Legislature who passed them, and are responsible for the obscurity of the Acts.” (Page 94- The Closing Chapter – Lord Dennings). The Act passed by the British Parliament was so ambiguous that Lord Scrutton regretted his inability to impose penalty (cost) on the persons who brought into existence such a loosely drafted law.

16. Another Judge Sir Ernest Gowers who said the following in the Plain Words case in the year 1948 as the duty of the draftsmen (Page 95 ibid.): “…. to try to imagine every possible combination of circumstances to which his words might apply and every conceivable misinterpretation that might be put on them, and to take precaution accordingly. ….All the time he must keep his eyes on the rules of legal interpretation and the case law on the meaning of particular words [and on the previous statutes on the same subject-matter] and choose his phraseology to fit them.”. We the Indians, who are said to have adopted the British system of governance more, have to demonstrate that we are capable of framing laws in a proper manner. But the present Bill No. 375 of 2019 does not fit into the parameters of proper law.

Nexus between Clauses 2 (26), 2 (80) and Clause 39(5):

17. I submit that the phraseology of Clauses 2 (26) and 2 (80) read with the phraseology of Claus 39 (5) give a discerning reader reason to believe that there is close nexus between the purpose for which these clauses have been inserted the way they are. I submit that I have used the phrase ‘reason to believe’ in the foregoing sentence with all its legal import as elucidated by the Hon’ble Supreme Court of India in Sony India Ltd Vs. Commissioner of Income Tax on 12.05.2005. The contents of Clause 39 (5) on the one hand and the contents of Clauses 2 (26) and 2 (80) on the other, lead one to the belief that there is a rational connection between the two. The contents of Clause 39 (5) do have a relevant bearing on Clause 2 (26) which leads to the formation of the aforesaid belief.

18. I, therefore, pray that action may kindly be taken to retain in the Bill on the Code on Social Security, 2019 (Bill No. 375 of 2019) the definition of the term ‘wages’ as given in Sec. 2 (22) of the ESI Act, 1948. In the alternative, the contents of Cl. 2 (80) of the said Bill No. 375 of 2019 may be caused to be re-examined and the following words and phrases deleted from the definition of the term ‘wages’ as given therein:

a. The phrase ‘any conveyance allowance or” appearing in the Exclusion Clause (d) of the definition has to be deleted;

b. The phrase ‘house rent allowance” appearing in the Exclusion Clause (f) of the definition has to be deleted;

c. The phrase ‘any overtime allowance” appearing in the Exclusion Clause (h) of the definition has to be deleted;

d. The phrase ‘any commission payable to the employee” appearing in the Exclusion Clause (i) of the definition has to be deleted;

e. The first proviso should be totally deleted as it does not have relevance in a social security enactment. In other words, this proviso starting with the phrase “provided that for calculating” and ending with the phrase “added in wages under this clause” requires to be deleted in toto.

Thanking you,

Yours faithfully,

Encl: Appendix.

Copy submitted to

The Secretary, Ministry of Labour & Employment, GOI, New Delhi.

The Secretary, Ministry of Law & Justice, GOI, New Delhi.

Filed under Benefits, For Trainees

The year was 1983. The ESI Corporation wanted to make some path-breaking changes and to bringing in suitable amendments. The Contribution Card system with stamps had already been replaced with the Contribution Card system with cash. The issue now was that the classification of employees into three sets, viz., A, B and C, was to be given a go by. Common Contribution Period and Benefit Period was being contemplated. The Hqrs. Office of the ESI Corporation asked the Regional Directors to offer their opinion. The Regional Directors asked, in turn, the field officers the Managers of the Local Offices and the Insurance Inspectors to explain their stand. The outcome was the evolvement of law which ensured the introduction of new system providing for all the practical difficulties in its implementation. The opinions offered ensured that the procedure evolved was not only not cumbersome but also one that advanced the purpose of the Act. Continue reading

Filed under Benefits, Labour Code 2020

It is Corona times. The date is 25.05.2020. Lord Yama Dharma Raja is hovering over the earth along with his assistant, Chitragupta, watching the events taking place in various nations under lock-down. For the past three months there were unusual increase in the number of entrants to his Court. While on the move, he gets attracted by the conversation of two men in a cocktail party at a hotel in New Delhi. He stopped moving further and has started observing their conversation. Chitragupta, who is standing nearby, is also keen to hear the duo, who were drunk and did not care to keep anything secret. Their conversation reveals that they are power-brokers in the capital of India who get things done from the politicians in power as desired by the business magnates who engage them. This night they are in an ebullient mood, feeling buoyant as if they are swimming in a pool of alcohol. Their conversation reveals that they are Mr. Wall and Mr. Suffer.

Mr. Suffer: Have some more drinks please! (Pours more into the glass of his companion).

Mr. Wall: Yes, Mr. Suffer! I agree, we should go on drinking and drinking. You can float in a pool of alcohol only as long as you swim. You will sink, if you stop swimming. Pour me more, I am so happy that we could influence the people in power to prepare the Code on Social Security the way our masters wanted.

Mr. Suffer: What a nice thing we have done! We have virtually wrecked the entire social security structure in India but project the image that we are expanding the structure. I am not able to control laughing. Nobody knows that a social security enactment of the nation could be so easily wrecked by tampering with the definition of the terms ‘employee’ and ‘wages’. Hah hah haa! We have poured hot water just at the root of the plant. And, it won’t be noticed by anyone. With this one single shot through Cl. 2 (26) and Cl. 2 (80) of the Bill No. 375 of 2019, the entire edifice of the social security structure evolved through the ESIC collapses in a flash. I caused it to be made that way. And the bureaucrats did what I wanted. Funny, the way the legislations are drafted by the bureaucrats who do not care for the poor.

Mr. Wall: Hey, I do not know anything about the concept of ‘wages’ you talk of. But I got what I wanted for PPP, divestment of medical colleges, etc., The manner in which we could cause various words and phrases inserted at various places in the Code is amazing, even for me. The interesting part of it is that nobody can understand the depth of those innocuous-looking phrases and foresee the impact of our mischief. We are very clever. So, we could cheat the others easily. But one thing. We could do all that only because the legislation is about the poor working class about whom nobody cares. We cannot do such thing in a legislation that would affect the rich.

Mr. Suffer: Yes, of course! Poor should be cared for by the government only. When the government is not inclined to be so, who will care for them. None. Moreover, the rich who care only for themselves are able to dictate terms to the government. We do not see rich benefactors like Robert Owen or George Cadbury in the Indian scene. They evolved the social security structure in the international arena. But the ultra rich in India want to wreck the already established structure. What is more? They are able to get the law they want by paying the political parties through Electoral Bonds. The party in power gets about 92% of such corporate donations. Naturally the nation goes the way the rich want it.

Mr. Wall: You are right! The Indian society becomes less civilised with every such labour law passed by the government recently to exploit the labour in the manner in which the rich wanted to exploit them. Anyway, our concern is that we should make money and it is the rich who pay us. Why should we then bother about the poor?

Mr. Suffer: Why should we? The politicians in power want to get the votes of the poor but they do not bother about the poor. Why we should feel concerned about them, then?

Mr. Wall: Yes, Mr. Suffer! You are right! We have convinced the politicians in power that they should choose between ‘Production in Industry’ and ‘Protection for the labour class’. Both cannot go together, we told them. They believed our theory.

Mr. Suffer: Funny, these politicians in power do not know that only strong labour welfare measures can increase production. They do not want to see what is happening in the civilised countries like Norway, Sweden, Finland, Japan, etc., They are more interested in getting money for their political parties from the Corporates. So all of them are at the beck and call of the Corporates and are ready to work as their agents instead of protecting the large mass which constitute the working class.

Mr. Wall: Be happy about it! It suits us! Otherwise we will also have to do some real work that would be really beneficial to the society. We cannot live this kind of happy parasitical life otherwise. Our work helps the rich exploit the masses without limit. I am surprised how the bureaucrats have been helping us in playing so many tricks in preparing the Code on Social Security to provide no meaningful security to the working population.

Mr. Suffer: Yes, the bureaucrats did not even explain to the politicians in power the circumstances under which various terminlogies had been defined in the ESI Act the way they have been and their importance in the Indian context. We know that as Sir William Beveridge said, industry in a nation will flourish, only when there is “Willing participation of labour”. But in India, the politicians in power do not want to listen to reason. They want to live off the rich; the rich want to live off the poor. The only goal amont the rich is to become ultra rich, and feature themselves in the Forbes magazine.

Mr.Wall: That they can achieve only when the politicians in power help them to exploit the poor through ‘Forced labour”. (He pours some more liquor for himself and drinks).

Mr. Suffer: I am not able to come out of the dizzy feeling I had when all our efforts bore fruit in the form of the Bill on the Code on Social Security, 2019 (Bill. No.375 of 2019) which contained the definition of the term ‘employee’ in Clause under Clause 2 (26) and the term ‘Wages’ under Clause 2 (80) as we wanted it. Nobody is going to notice it. Hah hah haa. With these two definitions, the entire ESI structure gets demolished so silently. The private insurers will then have a field day. I am so happy. I feel as if I am in heaven.

Mr. Wall: I feel that I am in heaven too.

(Lord Yama Dharma Raja looks at Chitragupta with a smile. Chitragupta smiles in response. He knows the meaning of the smile of the Lord and understands what is in store for this duo when they appear in the Court of the Lord, later.)

Mr. Suffer: Yes, of course. We have done a brilliant work. It requires a lot of talent to do what we have done. Even if you keep the present ESI Act in tact and continue to provide 70% to 90% of wages as compensation, the questionable phrases that we have caused to be included in the definition of the term ‘Wages’ under Cl. 2 (80) of the Bill No. 375 of 2019 would ensure that there is no meaningful social security net for the working population in India. What a marvellous work we have done! I admire at our own capability of deceit. And the bureaucrats, simply, fell for us. Oh, how easy to cheat the masses in India, with the help of the bureaucrats who do not care about their social responsibility under the Constitution!

Mr. Wall: Yes, yes! First of all, nobody cares for the poor; secondly, nobody knows where we have done what to undermine the social security system. Wah ! It is so easy to scuttle labour welfare measures in India.

Mr. Suffer: I admire myself ad infinitum. What a wonderful way in which I have caused insertion of the term “any overtime wages” in Clause 2 (80) and removed the same from Clause 2 (26) of the Bill concerned! Nobody knows the consequences of it. Because the overtime wages had been specified in Sec. 2 (9) of the ESI Act to be excluded for the purpose of coverage, but included for calculation of contribution payable on the wages defined under Sec. 2 (22) thereof. Its consequence has been phenomenally favourbale for the welfare of the labour, for the past 68 years. These terms have had a chequered history to protect the working population. But, we have reversed the relevant phraseologies in the present Bill on the Code on Social Security, in such a clever manner that it would be difficult for the people to understand the extent of the crime committed in drafting the Bill.

Mr. Wall: What would be the impact of such inclusions and exclusions?

Mr. Suffer: You see, the defintion of the term ‘wages’ as given in Sec. 2 (y) of the already promulgated Code on Wages, 2019 has been copied and pasted in Clause 2 (80) of the Bill on the Code on Social Security. The Code on Wages, 2019 replaced the Minimum Wages Act, 1948. The ESI Act had also been brought into existence only in 1948. But the term ‘wages’ had been defined differently in Sec. 2 (22) of the ESI Act. But now the bureaucrats did not care to examine why there was discrepancy between these two enactments while defining wages. They did not care either to analyse or even to record their observations in the Statement of Objects and Reasons accompanying the Bill on the Code on Social Security.

Mr. Wall: Why did the two Acts had two different definitions for the term ‘wages’?

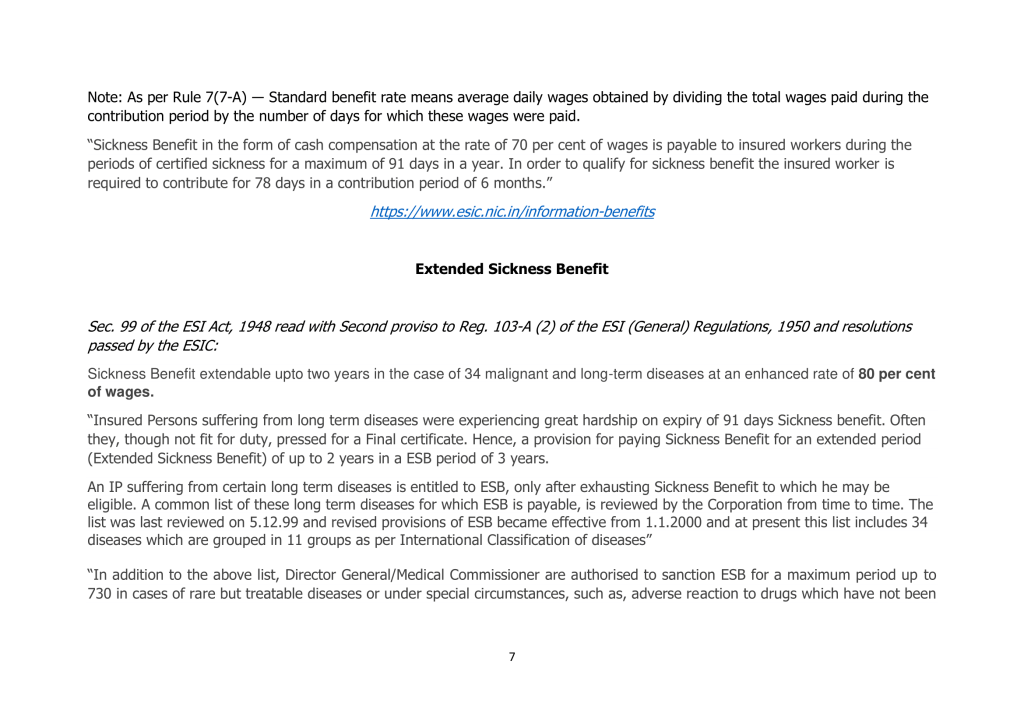

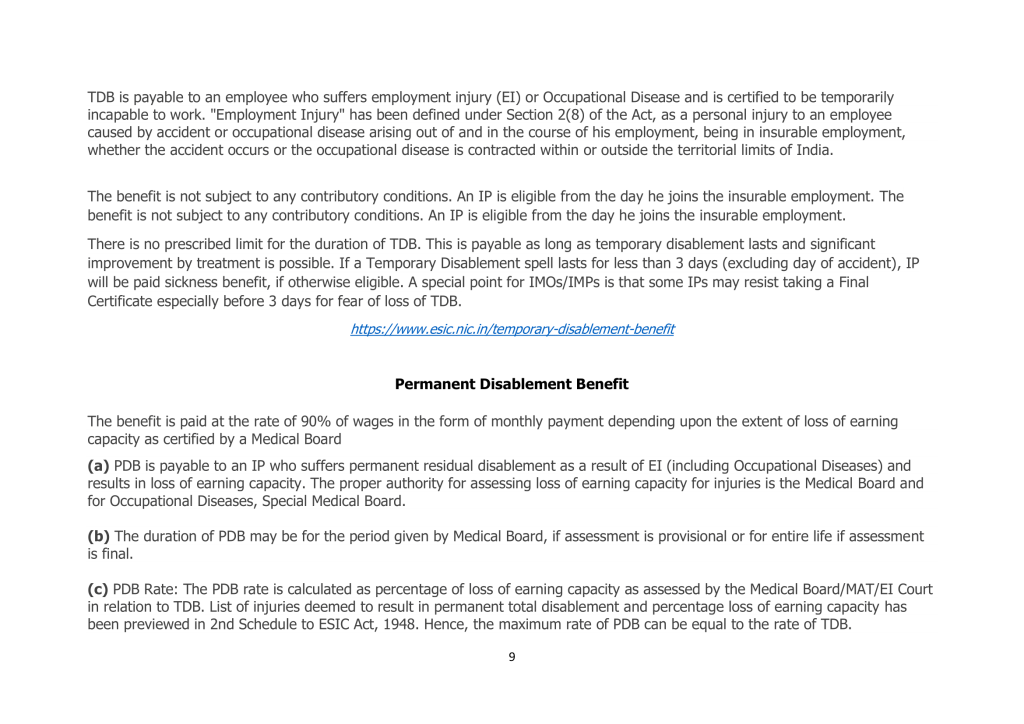

Mr. Suffer: The very purposes of the Minimum Wages Act, 1948 and the Employees’ State Insurance Act, 1948 were totally different. The former was intended to ensure that the working population got, at least, a certain minimum amount as wages and to prevent the employer from including many variable components of remuneration paid by him to the workers and showing them also as part of the said minimum wages. The latter was to ensure that the employer brought within the purview of social security provided by the State more employees by excluding many variable components so that the cash benefit that he would receive in the event of sickness or other contingencies would be attractive and substantial with reference to the total emoluments that he receives from his employer in whatever form, so that he would be able to maintain a reasonable standard of living during the periods of such unforeseen contingencies. For example, an employee who earns a sum of Rs. 20000 pm as wages now, would get about Rs. 14000 pm as Sickness Benefit, Rs. 16000 as Extended Sickness Benefit and Rs. 18000 as Total Disablement Benefit. This is the position as on date.

Mr. Wall: I understand now. It seems that the Minimum Wages Act, 1948 was for excluding many variable components of remuneration paid by the employer to identify the ‘wages’ while the ESI Act, 1948 was for adding many variable components of remuneration to the ‘wages’ paid otherwise. The definition in Sec. 2 (h) of the Minimum Wages Act, 1948 ensured not only a specific minimum as wages payable to the working population but also prevented the employer, through the ‘Exclusion Clause’ in the said Sec. 2 (h), from citing those extra allowances or payments as part of the said minimum wages.

Mr. Suffer: Yes. The goal of the Minimum Wages Act was to put at least a minimum money in the pocket of the worker while the goal of the ESI Act was to provide maximum possible cash benefit by the Government to enable the worker to meet the contingencies. There cannot, therefore, be one and the same definition of the term ‘wages’ for both enactments.

Mr. Wall: True. Both these enactments came into force immediately on the wake of independence and they came along with the another important labour welfare legislation, the Factories Act, 1948. The desire of the leaders of modern India, then, was not to allow exploitation of labour even after the independence of the nation. That was the precise reason for enacting all these legislations, on priority basis on attaining independence. It had been made clear in the Statements of Object and Reasons of all these three enactments, in the year 1948, that they were intended for the welfare of the working population.

Mr. Suffer: The definition of the term ‘wages’ in Sec. 2 (22) of the Employees’ State Insurance Act, 1948 read with the definition of the term ‘employee’ in Sec. 2 (9) of the said Act, (which specifically excluded over time allowance to decide the coverage of the insured person) ensured that the employee was not denied coverage because of variable components of remuneration but was given substantial amount as cash benefit (by taking into account many variable components of remuneration also as wages) and was thus enabled to maintain a reasonable standard of life even when he was affected by certain contingencies like Sickness, Disablement due to Employment Injury, etc.,

Mr. Wall: Yes, I got it. If the employee who draws total wages of Rs. 20000 is shown by the employer to have received only Rs. 7000 as wages and the remaining Rs. 13000 as extra allowances which have not been classified as Wages, as per Cl. 2 (80) of the Bill on the Code on Social Security, he would get only Rs. 4900 pm as Sickness Benefit, Rs. 5600 as Extended Sickness Benefit and Rs. 6300 as Total Disablement Benefit. As one who maintained his standard of life at Rs. 20000 pm, it would become very hard to him to maintain a reasonable standard at Rs. 4900 pm in the event of even ordinary sickness. It is essential in the context to know that the tendency of the employers to cheat and evade both his employees and the ESI Corporation has been real as borne out by the judgments of the courts of law in thousands of cases. A law-maker cannot just presume to the contrary and put the lives of the working masses at the mercy of the employers, going back once again to the pre-1948 era.

Mr. Suffer: Very funny, indeed. The bureaucrats do have neither the understanding of the concept of social security nor any understating of the consequences. That was why the draftsman had simply inserted in Cl. 2 (80) of the Bill on the Code on Social Security the entire definition of the term Wages as given in Sec. 2 (y) of the Code on Wages, 2019, as it is.

Mr. Wall: It is not only that. They do not even know why the merger of the ESIC and the EPFO could not take place for the past 40 years, in spite of various studies undertaken by them. That merger could not materialise only because the term ‘Wages’ for the purpose of compliance and contribution, could not be given a common definition to answer the purpose of both the ESI Act, 1948 and the EPF Act, 1952.

Mr. Suffer: Exactly. If only the present Bill on the Code on

Social Security, 2019 with its Cl. 2 (80) as it is becomes law, it will be a death-knell for the entire concept of social security in India. Our nation will go down even lower in the list of civilised nations, because Social Security provided by the government has been recognised world-wide as the symbol of civilisation. This Code will make the cash benefits payable to the beneficiaries (insured persons or their dependant family members) totally unattractive with reference to the real wages earned by the insured person.

Mr. Wall: Yes, you are right. That benefit will not be useful to the workers in any real sense, unless contribution is made payable by the employer on all items of wages paid by them, as per the existing definition under Sec. 2 (22) of the present ESI Act. There would be no real Social Security to the working population. There would be no real “State Insurance” although Chaper IV of the Code on the Social Security, 2019, proclaims to the public that there would be an “Employees’ State Insurance Corporation”.

Mr. Suffer: Hey, that is not our botheration. Let us celebrate our victory in our mission to destabilise the social security system of the nation. We are not Mahatma Gandhi. I wonder whether he would have fought for independence if only he had known that people like us would be roaming around in the independent India manipulating the bureaucrats to our will, which is in fact the will of our pay-masters, the ultra and greedy rich.

Mr. Wall: I understand. I find that there is no way for the nation to extricate itself from the web woven by you to destroy the social security system. Am I correct?

Mr. Suffer: True. As things stand, the enemies of the working population, the ultra-rich who have already cornered more than 75% of the national resources are commanding the politicians in power and demanding the laws they want in the manner in which they want them. It is as per their desires, I have woven a spider-net to trap and destroy the organisation which provides proper security-net to the working population. Yet, the social security system can be retrieved from the hands of these ultra rich, if the Parliamentary Standing Committee on Labour directs the bureaucrats to have a relook at the Cl. 2 (80) of the Bill on the Code on Social Security, 2019 (Bill No. 375 of 2019) and to delete the following from the definition therein for the term ‘wages’:

Mr. Wall: (After remaining silent for some time) Hey, Mr. Suffer! C’mon, let us go home. You have drunk too much. Your eyes are red.

Mr. Suffer: Yeah, yours are red too. (He tries to make a move reclining himself on the shoulders of Mr. Wall)

Mr. Wall: No. Yours are redder. Redder, much more.

(Lord Yama Dharma Raja looks at Chitragupta and nods at him to move on. Chitragupta notices that the eyes of the Lord are red.)

Filed under Labour Code 2020

A complaint had been lodged with the Hon’ble National Human Rights Commission on 01.05.2020, about the contents of the Code on Social Security, 2019 which has been tabled on the Lok Sabha as Bill No. 375 of 2019.

The essence of the Complaint was that the action and inaction of the said Secretary, Ministry of Labour & Employment, had resulted in violation of the continued right of the employees employed in factories and establishments covered under the ESI Act, to the existing social security benefits, which was their fundamental human rights and that he was guilty of having committed the offence under Sec.12 (a) (i) and (ii) of the Protection of Human Rights Act, 1993. (Copy of the complaint is available in https://flourishingesic.info/2020/05/01/complaint-to-the-nhrc-bill-violates-human-rights/

Hon’ble Commission examined the plea (Case No. 383/90/0/2020) and has given direction to the Secretary, Ministry of Labour & Employment “to take appropriate action at their end within 8 weeks associating the complainant / victim and inform them of the action taken in the matter”.

Filed under Labour Code 2019

Excerpts from the letter sent to the authorities on the unlawful and unwarranted inclusion of the phrase “Nursing and Para-medical” and the word “Gazetted” in Clause 24 (8) of the Code on Social Security, 2019 (Bill No. 375 of 2019) without any explanation for it anywhere in the Bill.

——————————–

2. I submit that although the aforesaid Clause 24 (8) has been modelled on the existing Sec. 17 (3) of the Employees’ State Insurance Act, 1948, the inclusion of (1) the phrase “Nursing and Para-medical” and (2) the word “Gazetted” therein is unwarranted either by operation of any law or because of any practical problem which could arise in the enforcement of the existing law. The simple fact is that this proposition under Clause 24 (8) is purely unwarranted and has not been made keeping public interest in view. There had been no in-depth study for making such a modification in the existing procedure permitted in the ESI Act. The proposition made, now, through the Clause 24 (8) of the Code on Social Security is arbitrary and hence unlawul.

3. The original ESI Act did not exempt even the medical posts. All appointments to posts corresponding to Class I and Class II posts under the Central Government were required to be made only in consultation with the Union Public Service Commission. The then Sec. 17 (3), i.e., the provision that was in force upto 26.01.1985, read as under:

“Every appointment to posts corresponding to Class I and Class II posts under the Central Government shall be made in consultation with the Union Public Service Commission”

4. As the classification of the posts based on Class was changed as a matter of policy by the Central Government, the subsequent amendment of 1984 reflected that policy decision and the amended provision which came into effect from 27.01.1985 read as under:

“Every appointment to posts corresponding to group A and group B posts under the Central Government shall be made in consultation with the Union Public Service Commission”.

5. The provisions of Sec. 17 (3) of the ESI Act, as quoted supra, were in accordance with the Art. 320 (3) (a) of the Constitution of India read with the Proviso thereto and the provisions in the UPSC (EFC) Regulations, 1958 (As amended).

Unwarranted amendment in 1989 and later regrets:

6. It was only in the year 1988 that a very big lobby that had been canvassing for a long time for exempting the medical posts from the purview of the UPSC, succeeded in its venture, for reasons which were specious. The UPSC had also accepted the proposal for it. The resultant amendment of 1989 saw the said Sec. 17 (3) of the ESI Act modified as under:

“Every appointment to posts (other than medical posts) corresponding to group A and group B posts under the Central Government shall be made in consultation with the Union Public Service Commission”.

It was later found that the reasons recorded earlier for amending the Sec. 17 (3) thus, to exempt the medical posts from the purview of the UPSC, were improper and wrong and the amendment unnecessary. The then Director General regretted later the amendment of 1989. There had been various unwarranted pressure on the honest Director Generals thereafter.

Unwarranted amendment in 2009 and later regrets:

7. Similar misadventure was there, again, twenty years later, in 2009. That was about the establishment and running of medical colleges by the ESI Corporation. And a Bill (Bill No 66-C of 2009) was tabled on the Lok Sabha to amend, inter alia, Sec. 59-B in the ESI Act to pave way for establishing such medical colleges by the ESI Corporation. A strong lobby, had been canvassing from the year 2007 onwards, through the Standing Committee and the ESI Corporation, for constructing large number of medical colleges. But after frittering away thousands of crores of the fund of the organisation, the same bodies recorded their regret, in the year 2015, and confessed that the ESI Corporation did not have core competency and that the objective of Sec. 59-B was unlikely to be met. The Minutes of the meeting of the Corporation on 05.01.2015 would testify to this fact. The ESIC was gifting away, subsequently, the mammoth buildings constructed at a huge cost to State Governments.

8. Taking wrong decisions first, making herculean efforts to amend the Act by informing, misinforming and disinforming the Parliament, and then regretting the decision after realising the wrongs committed earlier did not remain a one-time phenomenon. It has become a recurring feature as could be seen from the contents of the present Bill No. 375 of 2019 in the Lok Sabha.

Unwarranted meddling, again, in 2019:

9. Now, ten years later, in 2019, another attempt has been made to yield to another lobby. The proposition for the inclusion of the phrase “Nursing and Para-medical” and the word “Gazetted” therein has no legitimate justification at all. It is the indicator of yielding to such a lobby. And the regrets will be coming later. This is not only in violations of the provisions in the UPSC (EFC) Regulations, 1958 (as amended up to 07.10.2009) but also not necessary, in public interest.

10. I, therefore, submit that it is only right and proper to take action at least at this stage to prevent such a defective Clause from becoming law by deleting the said word and phrase from the proposed Clause 24 (8) of the Code on Social Security, 2019, and, consequently, take action to prepare the said Clause identically on the lines of the existing Sec. 17 (3) of the ESI Act, 1948.

11. It is a fact that the Bill No. 375 of 2019 does not explain how and why the phrase “Nursing and Para-medical” and the word “Gazetted” have been added all of a sudden in Clause 24 (8) of the Code on Social Security, 2019 without explaining the need for it, either in the ‘Statement of Objects and Reasons’ or even in the ‘Note on Clauses’.

12. The ‘Statement of Objects and Reasons’ is totally silent on this issue. The ‘Note on Clauses’ contain only a laconic observation that “Clause 24 of the Bill seeks to provide appointment of Principal Officers and other staff of the Corporation”. It is very clear that the Legislature is just ill-treated by the Executive.

UPSC (EFC) Regulations violated by the ESIC:

13. It is essential for the Executive to convince the Legislature about the necessity that had arisen, from the perspective of the Executive, to make such additions. But the Executive has deliberately omitted doing so, in the matter of including the Nursing and Para-medical staff in the said Clause 24 (8). The bureaucrats have inserted these additions silently and without inviting the particular attention of the legislators for such an addition, especially when the Recruitment Regulations for the post of Nurses have been amended only in July 2019, in accordance with the law on the subject and, accordingly, conceding the role of the UPSC in the matter of appointment and promotion of Nurses in Group B and A.

14. In fact, the proposal for such an amendment was sent by the ESI Corporation, after inviting comments from the stakeholders two years ago, on 04.05.2017, and the UPSC, has given its concurrence to those amendments as per its letter F. No. 3/12 (8) /2019 – RR dated 05.07.2019 and has, thereby, assumed jurisdiction over the appointment and promotion of Nursing personnel in the ESI Corporation. The salient features of those amendments were:

a. The posts in the Nursing cadre were re-designated and re-classified as Nursing Officer ( Group B ), Senior Nursing Officer (Group B) and Assistant Nursing Superintendent (Group A).

b. The recruitment process in respect of all these posts would go to the UPSC.

c. The DPC meeting would be conducted by the UPSC and a member of the UPSC would be the Chairman of the DPC.

15. When all these actions are facts on record, there should be convincing reason advanced by the ESIC in the ‘Statement of Objects and Reasons’ and the ‘Notes on Clauses’ accompanying the Bill No. 375 of 2019, for deliberately violating the provisions of the UPSC (EFC) Regulations, 1958 and trying to usurp the powers of the UPSC. But the Bill concerned is totally silent on the issue.

Legislative Policy, a pre-requisite for Legislative Drafting, kept secret:

16. The Parliamentarians are entitled to know who made what changes in this Clause and who advised whom to insert the phrase “Nursing and Para-medical” and the word “Gazetted” in the Clause 24 (8) of the Bill No. 375 of 2019. The desire of the bureaucracy to keep this information secret is unlawful and impermissible. The legislature should always be, invariably, informed of the specific reasons behind the deletion of existing words and phrases and insertion of these new words and phrases in the already existing provisions. The legislative policy behind such a proposition should be made known to the Legislature beforehand. That has not been done in this case.

17. The procedure of drafting legislations require the rulers to entrust the Drafting Team with the ‘legislative policy’. Mr. Justice. M. Jagannadha Rao, Chairman of the 17th Law Commission of India, has written a paper on Legislative Drafting. He says, “The draftsman is not the author of the legislative policy, he merely tries to transform the legislative policy into words. The legislative policy is made by the political executive which belongs to the political party which is ruling the legislature or by the monarch who reigns over the country. The draftsman must, therefore, digest the legislative policy fully before he produces the instrument of legislation which can achieve the legislative purpose”. The issue here, with the impugned Code, is why the Executive has not made the concerned ‘legislative policy’ also known not only to the public but even to the Legislature. The Executive has not informed the Legislature about the direction in which the draftsman was advised to make a move, while drafting the Bill No. 375 of 2019. And that is unlawful.

The strange insertion of the word ‘Gazetted’:

18. It is submitted that the word ‘Gazetted’ inserted in Cl. 24 (6) of the Bill No. 375 of 2019 restricts the jurisdiction of the UPSC in respect of Groups B posts, which jurisdiction is now available under the existing Sec. 17 (3) of the ESI Act. The proposed law is that “Every appointment to posts..….corresponding to group A and group B Gazetted posts under the Central Government shall be made in consultation with the Union Public Service Commission”. This inclusion of the word ‘Gazetted’ in Clause 24 (8) in the Bill concerned is not at all necessary when the UPSC had already assumed jurisdiction over all the Group B Non-Gazetted posts also, in the Stenographic cadre as well as in the Nursing cadre. Moreover, no explanation to justify such an inclusion has been given either in the “Statement of Objects and Reasons” or in the “Notes on Clauses” accompanying the Bill. The draftsman did not think it necessary to adduce reasons and convince the law-makers for such an inclusion. His action and inaction are improper and unlawful and is a serious misconduct.

Inaction of the Ministry of Law:

19. Moreover, it is shocking that the Legislative wing of the Ministry of Law & Justice had not considered it necessary to probe into the legality or otherwise of this kind of silent insertion of the phrase “Nursing and Para-medical” in the Bill No. 375 of 2019, especially when the legislation, the Code on Social Security, 2019 is not a new one but one intended only to replace the ESI Act, 1948 and 8 others. Besides, the Ministry of Law ought to have made the Ministry of Labour & Employment explain its stand, about the absence of explanations to such commissions and omissions in the ‘Note on Clauses’ and the ‘Statement of Objects and Reasons’ which accompanied the Bill.

Observations of the Apex Court:

20. It is submitted that the Clause 24 (8) of the Code on Social Security, 2019 deals with the policy pertaining to public employment. Such an important policy cannot be evolved without there being a transparent legislative policy. It is only when the Bill in question is compared with the aforesaid legislative policy, one would be able to know whether the draftsman had performed his role right or had made such commissions and omissions in the draft Code to sabotage the policy.

21. It would be appropriate to recall in the context what the Hon’ble Apex Court had said, in Ramana Dayaram Shetty vs. The International Airport Authority of India and others (04.05.1979). Drawing support from the proposition laid down in M/s. Erusian Equipment and Chemicals Ltd, Hon’ble Supreme Court had observed as under: “This proposition would hold good in all cases of dealing by the Government with the public, where the interest sought to be protected is a privilege. It must, therefore, be taken to be the law that where the Government is dealing with the public, whether by way of giving jobs or …., the Government cannot act arbitrarily at its sweet will and, like a private individual, deal with any person it pleases, but its action must be in conformity with standard or norm which is not arbitrary, irrational or irrelevant.”

Prayer

22. The phrase “Nursing and Para-medical” and the word ‘Gazetted’ inserted in the Clause 24 (8) of the Bill No. 375 of 2019 would adversely affect the chances of employment of the aspiring candidates of the nation in the ESI Corporation, if and when the Bill becomes law, without proper modifications. It is unnecessary and totally unwarranted to take the jurisdiction of the UPSC away from the Group B posts in the ESIC. It is not in public interest too.

23. I, therefore, request you to kindly re-examine the issue and set things right in the interest of the nation.

Filed under Labour Code 2020

To

1. Hon’ble Speaker,

House of the People (Lok Sabha),

17, Parliament House,

New Delhi 110011

2. Mr. Bhartruhan Mahtab,

Hon’ble M.P. & Chairman,

Standing Committee of Parliament on Labour,

South Block,

New Delhi – 110011

(Through Mr. Kulvinder Singh, Deputy Secretary, Parliament of India,

House of the People. Email: comm.labour-lss@sansad.nic.in)

Sub: Appointment of Consultants and Specialists in ESI Corporation – – insertion of Second Proviso to Clause 24 (7) (a) of the Bill No. 375 of 2019 – legislative process – bureaucrats continue to cheat the Parliament – representation – submitted.

Ref: 1. Bill No. 66-C of 2009 placed before the Lower House of the Parliament as The ESI (Amendment) Bill, 2009 on 30.07.2009.

2. Report dated 09.12.2009 of the Parliamentary Standing Committee on Labour.

3. Record (Minutes) of the proceedings of the Lok Sabha on 03.05.2010.

4. Bill No. 66-C of 2009 as passed by the House of the People on 03.05.2010 titled The ESI (Amendment) Bill, 2010.

5. CAG Report No. 40 of 2015 on Special Audit of Medical Education Projects in the ESI Corporation.

6. Draft Code on Social Security circulated in the MOL&E Circular No. Z-13025/13/2015-LRC dated 17.09.2019.

7. The Code on Social Security, 2019, placed as Bill No. 375 of 2019 before the House of the People (Lok Sabha).

—

Sir,

1. I submit this representation to the Parliamentary Standing Committee on Labour (hereinafter referred to as the PSCL) with a request to kindly examine in depth the Second Proviso to Clause No. 24 (7) (a) of the Bill on The Code on Social Security, 2019 (Bill No. 375 of 2019 of the Lok Sabha) which has been worded in a nebulous and ambiguous manner.

2. This Clause is shown to have been included for the purpose of appointing Specialists and Consultants in the ESIC Hospitals for better delivery of Super Speciality Services. But this clause which is the exact reproduction of the Second Proviso to the Sec. 17 (2) (a) of the ESI Act, 1948 did not serve that purpose. In fact the Second Proviso to the Sec. 17 (2) (a) of the ESI Act, 1948, was inserted in the ESI Act, ten years ago, with ulterior motive, through an amendment vide Bill No. 66-C of 2009 of the Lok Sabha, and it had been the cause of various scandals unearthed later by the Comptroller and Auditor General of India and some of them recorded in Para 2.3, Para 2.4 and Para 2.5 of his Report No. 40 of 2015 (Page 8 to 12 – Special Audit of Medical Education Projects).

3. I submit that such scandals became possible because of (a) the insertion of that provision as Second Proviso to Sec. 17 (2) (a) of the ESI Act, 1948, instead of its appropriate place as the Second Proviso to Sec. 17 (3) of the said Act and (b) the absence of insertion of definition to the terms ‘Specialists’ and ‘Consultants’ in the ESI Act along with the aforesaid amendment.

4. I therefore submit that the present Cl. 24 (7) (a) of the Bill No. 375 of 2019, as it is at present, would definitely become the cause of further abuse as had happened in the past decade in the ESI Corporation, unless the PSCL inquires the authorities of the facts behind it and causes modification of it. What is required to be done is to insert this Clause in its appropriate place below the Cl. 24 (8) of the Bil No. 375 of 2019 and to incorporate, in the Bill itself, the definitions for the terms ‘Specialists’ and ‘Consultants’. I, therefore, request that the Committee may kindly bestow more attention for evaluating this provision, in the light of facts submitted in this representation and the Appendices.

5. The Second Proviso to the Clause No. 24 (7) (a) of the Bill No. 375 of 2019 which is, now, under the scrutiny of the PSCL at present reads as under:

“Provided further that this sub-section shall not apply to appointment of consultants and specialists in various fields appointed on contract basis.”

6. The second proviso to the Clause 5 of the Bill No. 66-C of 2009, introduced ten years ago to make amendment to Sec. 17 (2) (a) of the ESI Act,1948, which was scrutinized by the then PSCL, read as under:

“Provided further that this sub-section shall not apply to appointment of consultants and specialists in various fields appointed on contract basis.”

7. The PSCL had examined this provision in depth then and did not approve it the way it approved many of the other genuine provisions in the Bill No. 66-C of 2009. Yet the procedure had been manipulated, the observations of the PSCL overlooked and the defective Clause 5 of the Bill became law on 03.05.2010 enabling the persons in power to indulge in various scandals.

8. I submit that this Clause, which had been inserted in through the Bill No. 66-C of 2009, was not an innocuous provision. It was inserted in a pre-meditated manner with a view to indulge in various scandals. Instead of placing it as the second proviso to Sec. 17 (3) of the ESI Act, the bureaucrats connived to insert it as the second proviso to Sec. 17 (2) (a) of the ESI Act. (Please see Appendix B). Their apparent intention was (i) to appoint anyone as Specialist or Consultant for any non-medical purpose, (ii) to ignore the proper method of recruitment, (iii) to pay such an appointee extraordinary remuneration without any guideline being anywhere and (iv) to keep those appointees beyond the pale of all kinds of disciplinary provisions. I request that this provision need not again be made a part of law through the proposed Code on Social Security, 2019 vide the Bill No. 375 of 2019 which is now under the effective consideration of the PSCL.

9. It is essential for the PSCL to know the fact that when the Secretary, Department of Economic Affairs, suspected the bona fides of the provision in the Bill No. 66-C of 2019 and came forward with valid suggestion during the meeting of the Committee of Secretaries held on 06.01.2009 to prevent the abuse of this provision, the Director General, ESI Corporation chipped in and clarified that it was only an enabling provision and that the rules would be framed later. His defence was endorsed by the Cabinet Secretary who was present in the meeting and observed that the issue might be examined “at the time of framing of rules.” But it is a pity that the promises of the Director General of the ESI Corporation and the Cabinet Secretary were not kept. Consequently, no rules under the provisions of Subordinate Legislation have ever been framed regarding the appointment of Specialists and Consultants till date, although many had been appointed through questionable means in the organization leading to the objection by the CAG too.

10. I, therefore, request that the Parliamentary Standing Committee on Labour may be pleased

a. to dispense with this provision altogether and direct the ESI Corporation to follow the procedure adopted in the AIIMS, JIPMER, etc., for appointment of Specialists and Consultants in medical fields, or

b. to advise the authorities concerned to formulate the provision properly to enable them to appoint only the Specialists and Consultants with medical qualifications to meet the requirement of the ESI Corporation in providing super speciality medical benefit to the ailing beneficiaries in the ESIC run medical institutions;

c. to advise the authorities to incorporate suitable definition for the terms ‘Specialists’ and ‘Consultants’ under Clause 2 of the Bill under consideration; and

d. to shift this impugned proviso from the present position as the Second Proviso to Clause 24 (7) (a) of the Bill on the Code on Social Security, 2019 ( Bill No. 375 of 2019) and to insert the same as the Second Proviso to Clause 24 (8) of the said Bill to prevent abuse of the provision once again by making extraordinary payments to the people who are appointed as Specialists and Consultants. (Please see Appendix C)

11. I submit herewith a Write-up containing the relevant details pertaining to the abuse of law-making-process in the year 2009 and 2010 to insert the Second Proviso under Sec. 17 (2) (a) of the ESI Act. I believe that the PSCL may find the precedent and the details thereof useful to arrive at a decision, as deemed fit, on the unwarranted Proviso which has been inserted as Clause No. 24 (7) (a) of the Bill,

Yours faithfully,

Encl: Appendices A, B & C.

Filed under Labour Code 2020

Hon’ble Supreme Court has, in Vasantlal Maganbhai Sanjanwala Vs. The State of Bombay and others on 25.08.1960 referred, in a different context, to the possibility of legislature, “controlled by a powerful executive”. That possibility is proved to have become a reality in India as demonstrated by the wily bureaucrats when it came to the amendment of Labour laws, especially the Bill No. 66-C of 2009 and the Bill No.375 of 2019.

The manner in which the Cl. 40 (9) had been inserted in the Bill on The Code on Social Security, 2019, (Bill No. 375 of 2019) pending in the House of the People (Lok Sabha) shows how wily the bureaucrats could be, again and again. Identical Clause was introduced in the Bill No. 66-C of 2009 to amend the ESI Act, 1948.

But the then Parliamentary Standing Committee on Labour (PSCL) rejected that provision categorically assigning strong reasons. Yet without being aware of the said observations of the PSCL, the provision was made to become law during a pademonium without discussion on 03.05.2010.

Now the Bill No. 375 of 2019 containing the same provision is before the present PSCL. Attempt is made to apprise the PSCL of the history of the case to save the social security structure from being corroded further.

Copy of the letter dated 14.05.2020 sent to the Hon’ble Speaker, House of the People is reproduced hereunder:

======================================================

To

| 1 | Hon’ble Speaker, House of the People (Lok Sabha), 17, Parliament House, New Delhi 110011 |

| 2 | Mr. Bhartruhan Mahtab, Hon’ble M.P. & Chairman, Standing Committee of Parliament on Labour, South Block, New Delhi – 110011. |

(Through Mr. Kulvinder Singh, Deputy Secretary, Parliament of India,House of the People. Email: comm.labour-lss@sansad.nic.in)

| Sub: | Third party participation in running the ESIC hospitals and medical institutions – insertion of Sec. 59 (3) of the ESI Act, 1948 in the year 2010 – Clause 40 (9 ) of the Bill No. 375 of 2019 – bureaucracy deceiving the Parliament – Representation – submitted. |

| Ref: | 1. Bill No. 66-C of 2009 placed before the Lower House of the Parliament as The ESI (Amendment) Bill, 2009 on 30.07.2009. 2. Report dated 09.12.2009 of the Parliamentary Standing Committee on Labour. 3. Record (Minutes) of the proceedings of the Lok Sabha on 03.05.2010. 4. Bill No. 66-C of 2009 as passed by the House of the People on 03.05.2010 titled The ESI (Amendment) Bill, 2010. 5. Hqrs. Letter No. U-11/14/1/20-15-Med.I (ICU) dated 20.04.2018 addressed to M/s Sheel Nursing Home Pvt Ltd, Uttar Pradesh. 6. Draft Code on Social Security circulated in the MOL&E Circular No. Z-13025/13/2015-LRC dated 17.09.2019. 7. The Code on Social Security, 2019, placed as Bill No. 375 of 2019 before the House of the People (Lok Sabha). |

Sir,

I submit that Hon’ble Supreme Court has, in Vasantlal Maganbhai Sanjanwala Vs. The State of Bombay and others on 25.08.1960 referred, in a different context, to the possibility of legislature, “controlled by a powerful executive”. That possibility is proved to have become a reality in India as demonstrated by the bureaucrats, again and again, when it came to the amendment of Labour Laws, especially the Bill No. 66-C of 2009 and the Bill No.375 of 2019, as explained below. In the context, I consider it necessary to invite your kind attention to Clause 40 (9) of the Bill No. 375 of 2019 which is under the consideration and scrutiny of the Parliamentary Standing Committee on Labour at present. The said Clause reads as under:

“The Corporation may also enter into agreement with any local authority, local body or private body for commissioning and running Employees’ State Insurance hospitals through third party participation for providing medical treatment and attendance to insured persons and (where such medical benefit has been extended to their families), to their families.”

2. Identical is the provision under Sec. 59 (3) of the ESI Act, which was inserted through the amendment of the year 2010, vide Bill No. 66-C of 2009:

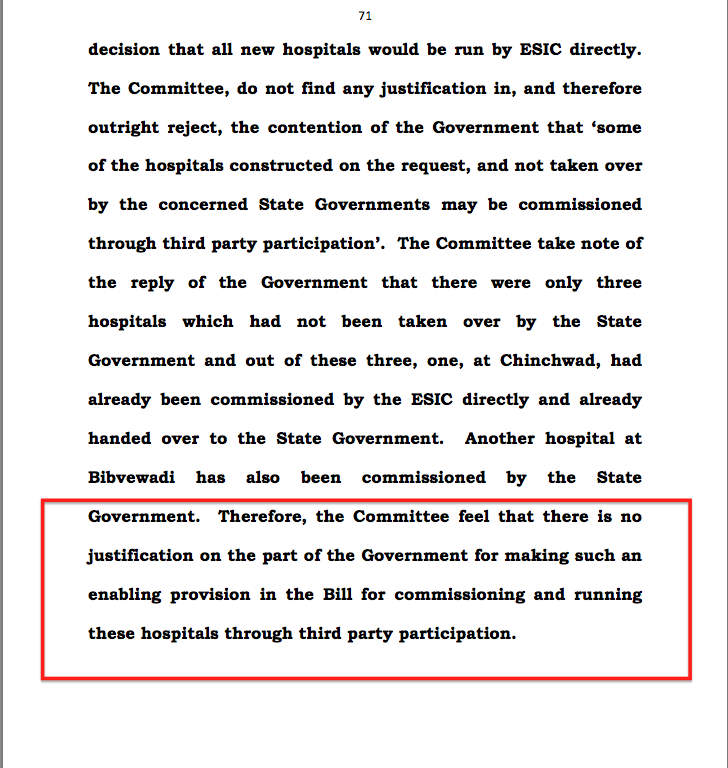

3. I submit that this provision, i.e., the Sec. 59 (3) of the ESI Act which is in force as on date and the proposed Cl. 40 (9) of the Bill No. 375 of 2019, enable Third Party participation in commissioning and running the ESI hospitals and providing medical treatment and attendance to insurance persons and their families.

4. When the above provision was proposed to be inserted in the ESI Act in 2009, as Sec. 59 (3), vide Clause No. 14 of the Bill No. 66-C of 2019 introduced in the Lok Sabha, the Parliamentary Standing Committee on Labour had examined the issue rejected the proposal outright as could be from Para 113 of its Report presented to the Lok Sabha on 09.12.2009. The Committee did not permit making such an enabling provision in the Bill for commissioning and running these hospitals through third party participation Para 113 said,

“113. The Committee note the proposal of the Government for making a provision for commissioning and running of ESI hospitals through third party participation. The Committee find that ESIC has the required capacity and wherewithal to run hospitals on their own since Government have taken a decision that all new hospitals would be run by ESIC directly. The Committee, do not find any justification in, and therefore outright reject, the contention of the Government that ‘some of the hospitals constructed on the request, and not taken over by the concerned State Governments may be commissioned through third party participation’. The Committee take note of the reply of the Government that there were only three hospitals which had not been taken over by the State Government and out of these three, one, at Chinchwad, had already been commissioned by the ESIC directly and already handed over to the State Government. Another hospital at Bibvewadi has also been commissioned by the State Government. Therefore, the Committee feel that there is no justification on the part of the Government for making such an enabling provision in the Bill for commissioning and running these hospitals through third party participation”.

5. Yet, those observations of the Parliamentary Standing Committee on Labour had not been taken to the notice of the Members of the Lok Sabha on 03.05.2010 in an appropriate manner that would make them pay attention to the differing views of the Standing Committee. Consequently, the original Clause 14 in the Bill No. 66 of 2009 was made to become law in the form of Sec.59 (3) of the ESI Act. That provision was, thus, the outcome of an unlawful and unjust and undemocratic law-making-process.

6. It becomes clear, from the Minutes of the Parliamentary Proceedings, that the authorities did not want to care for the well-considered observations of the Parliamentary Standing Committee on Labour and had, therefore, omitted any reference to the abovementioned observation of the Committee in Para 113 of its report. That was why even the already prepared speech of the Hon’ble Minister did not contain any reference, at all, to the Para 113 of the Report containing the objection of the Parliamentary Standing Committee to Clause 14 which was to become Sec. 59 (3) in the Act, later.

7. Besides, the Bill got passed by the Lok Sabha within a time span of nine minutes between 1420 hours and 1429 hours on that day, the 3rd May 2010, when the issue pertaining to Sibu Soren was creating a pandemonium in the House without allowing any meaningful discussion. Significantly, the Hon’ble Minister did not, actually, deliver, in the house, that portion of the speech which is available in Pages 60, 61 & 62 of the Minutes dated 03.05.2010 but had just laid it on the table on the advice of the Hon’ble Deputy Speaker, as could be seen from the live telecast that day.

8. The fact, in essence, is that the Parliament of India had not consciously approved the amendment for and before inserting the aforesaid Sec. 59 (3) in the ESI Act, 1948. It did not examine the observations of the report of the Parliamentary Standing Committee on Labour dated 09.12.2009. The Legislature had been tricked on 03.05.2010 by the Executive, whose intention was only to observe the formality of getting the Bill declared by the Speaker as passed on the floor of the Lok Sabha. The Executive had not been sincere and honest in giving right and complete information to the Legislature on this issue before asking for its approval.

9. The Executive had, with mala fide intention, placed the Clause 14 of the original Bill No. 66 of 2009, in its original form itself before the Parliament, even after the Parliamentary Standing Committee had objected to the said draft proposal in Para 113 of its Report. It is not the ‘end’ result but the ‘means’ adopted by the Executive to achieve that ‘end’ which makes the said Sec. 59 (3) vulnerable and amenable to judicial scrutiny.

10. While Parliament is not bound by the recommendations of the Parliamentary Standing Committee, it cannot just ignore the findings of the latter. Parliament has to apply its mind to the observations of the Parliamentary Standing Committee and record that it was differing from the stand of the said Committee. But in this case the Lok Sabha had simply been oblivious of the vital observations of the Standing Committee in Para 1134 of its report. The Executive did not make any efforts to draw the particular attention of the Parliamentarians to the stand of the Standing Committee to the then proposed Sec. 59 (3) of the ESI Act.

11. What is shocking all the more is that the same provision appeared as follows as Cl. 43 (9) in the draft circulated on 17.09.2019 and withdrawn in the first week of October 2019, at the behest of the PMO to rejig the draft. The present Cl. 40(9) in the Bill on the Code on Social Security, 2019, (Bill No. 375 of 2019) is the identical replica of the same provision, as quoted in Para 1 supra. This Bill has also been referred now to the Parliamentary Standing Committee on Labour without informing that Committee that the same issue had been examined by the earlier Parliamentary Standing Committee and had been rejected by it. The Executive has thus been consistently playing tricks with the Parliamentarians and cheat them as a matter of routine by suppressing facts from the knowledge of the Parliamentarians.

12. I, therefore, request that the members of the present Parliamentary Standing Committee on Labour may be informed,specifically, of the contents of Para 113 of the of the Report presented to the Lok Sabha on 09.12.2009 by the earlier Committee, so that the present Committee concerned could take an informed decision.

13. It would also be appropriate for the present Parliamentary Standing Committee on Labour to delve a little deeper into the manner in which various instances had taken place during the last decade through that Sec. 59 (3) of the ESI Act, 1948, especially those involving the agency called M/s Sheel Nursing Home Pvt Ltd referred to in the Hqrs. letter dated 20.04.2018, before and for taking decision on the Clause No. 40 (9) of the Bill on Social Security Code, 2019, which is now under the consideration of the said Committee.

Thanking you,

Yours faithfully,

Filed under Labour Code 2020

30.04.2020

To

The Chairman,

National Human Rights Commission,

Manav Adhikar Bhawan,

C-Block, GPO Complex,

INA, New Delhi 110023.

| Sub: | Code on Social Security Code, 2019– no assurance for continuation of the existing benefits provided under the ESI Act at present – violation of fundamental human rights –provisions of distributive justice – ignored – complaint – lodged. |

| Ref: |

|

Sir,

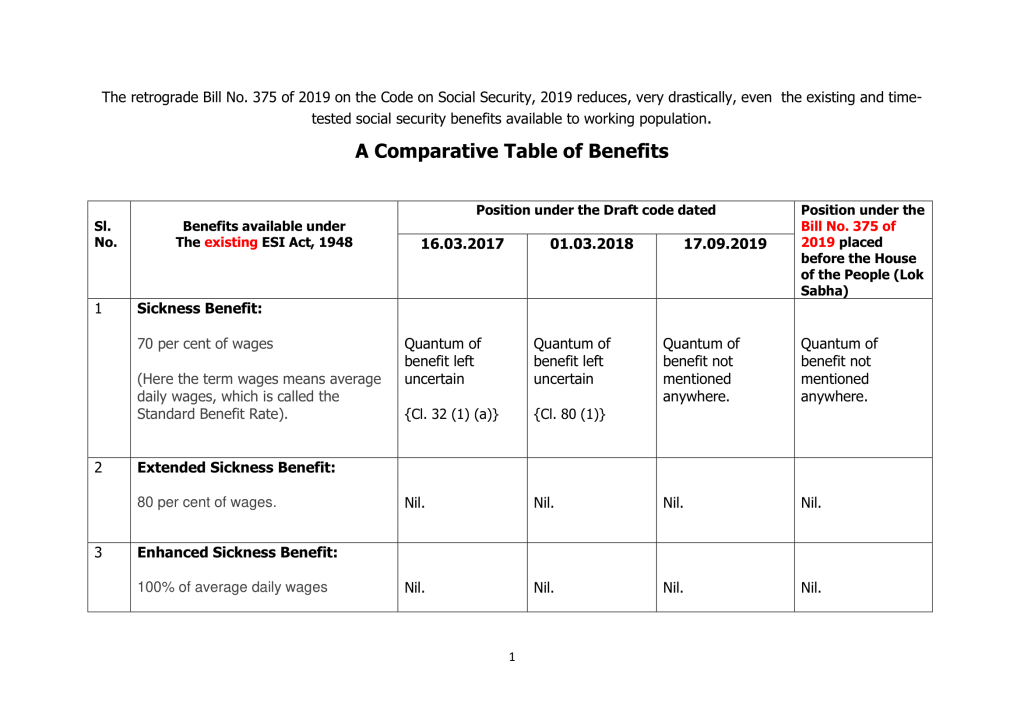

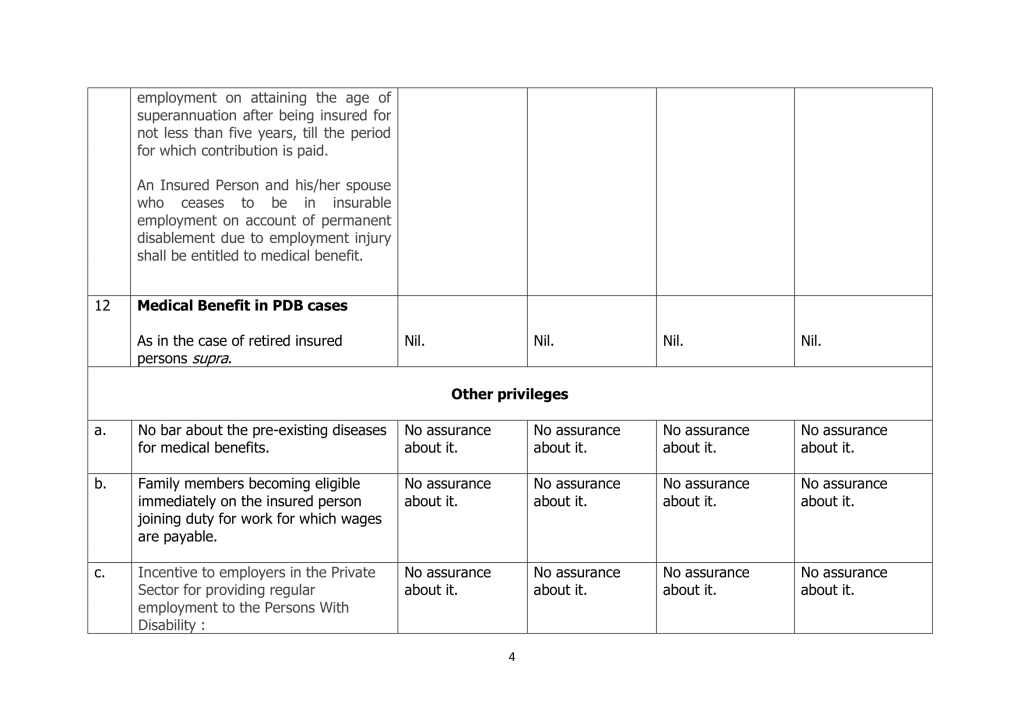

1. I submit that I am constrained to file this complaint, as the officials of the Ministry of Labour, Government of India, have been constantly making attempts, for the past three years, to reduce, in one way or the other, the benefits enjoyed by the working population of India, under the Employees’ State Insurance Act, 1948 (hereinafter referred to as the ‘ESI Act’), which enactment gives effect to Art. 1 of the Universal Declaration of Human Rights, 1948. The first attempt at such reduction was made by those officials in the Ministry of Labour, in the year 2017, when they put the Draft “Labour Code on Social Security & Welfare, 2017” in public domain on 16.03.2017 inviting “comments/suggestions” of the stakeholders, “as a part of pre-legislative consultative process”. Clauses 53 – 87 of this Draft Code showed very explicitly that the intention of the officials of the Ministry of Labour was to reduce the benefits made available to the working population covered under the ESI Act.

2. Some such reductions, as given below, are illustrative of the mala fide intention of the officials who drafted the Code or those who prepared the Drafting Policy for preparing such a Code, in the year 2017:

In addition to the aforesaid issues connected with the benefit provisions of the ESI Act, the very method of drafting the said code was found to be so amateurish and clumsy that the authorities had withdrawn the Draft “Labour Code on Social Security & Welfare, 2017” in toto, when those defects had been pointed out to them.

3. Adequate amount of compensation (called as ‘Benefits’ in legal parlance) to the working population ensures decent livelihood. The benefits provided under the ESI Act remain a goal post assuring the working population of acceptable standards of quality of life, when in distress. It is towards this goal, the rest of the working population not yet covered by the ESI Act, should be led to. The original ESI Act of the year 1948 itself, provides for such expansion and extension. It is significant to recall in the context that the Hon’ble High Court of Madras has, while dealing with issues pertaining to the ESI Act, observed that “the object of the Act is to provide certain benefits to the employees or dependants in case of sickness, maternity and employment injury, etc., to give effect to Art. 1 of the Universal Declaration of Human Rights, 1948, which assures human sensitivity of moral responsibility of every State that all human beings are born free and equal in dignity and rights” (C. Indira Vs. Senthil & Co. – 2009 (2) LLN. 302). “The object of the legislation is to protect the weaker section with a view to do social justice” (Chandramathi Vs. ESIC – 2003 (4) LLN. 1143). Such an important statute, the ESI Act, has been providing five major benefits along with many other important benefits to the working population for the past 68 years. Not many employers could provide superior or substantially equivalent benefits and get exemption as provided for under Sec. 87 – 91 of the Act.

4. Hon’ble Supreme Court has, in its judgment dated 10.05.1995, in LIC of India Vs. Consumer Education & Research Centre, held, “Right to livelihood springs from the right to life guaranteed under Article 21. The health and strength of a worker is an integral facet of right to life. Right to human dignity, development of personality, social protection are fundamental rights to the workmen. Medical facilities to protect the health of the workers are fundamental rights to workmen. It was, therefore, held that “the right to health, medical aid and to protect the health and the vigour of a worker while in service or post retirement is a fundamental right under Article 21 read with Articles 39(e), 41, 43, 48-A of the Constitution of India and fundamental human right to make the life of workmen meaningful and purposeful with dignity of persons.

5. Hon’ble Supreme Court added, “In Regional Director, ESI Corporation v. Francis De Costa, 1993 supp (4) SCC 100 at 105, the same view was stated. Security against sickness and disablement is fundamental right under Article 25 of the Universal Declaration of Human Rights and Article 7(b) of international Convention of Economic, Social and Cultural Rights and under Articles 39(e), 38 and 21 of the Constitution of India. Employees State Insurance Act seeks to provide succour to maintain health of an injured workman and the interpretation should be so given as to give effect to right to medical benefit which is a fundamental right to the workman”.

6. But the authorities of the Ministry of Labour did not want the Indian society to attain such an ideal level. They made attempt once again in the year 2018 to reduce the benefits already available to the working population under the ESI Act. They, therefore, brought in the revised Draft “Labour Code on Social Security, 2018” on 01.03.2018. Clause 63 (Part I), 78 (Part J), of the Draft Code of the year 2018 would testify to mala fide intention of the officials of the Ministry of Labour to reduce the benefits, in contrast with Sec. 46 of the ESI Act and the relevant rules made thereunder. This was also withdrawn later as that draft also did not meet the standards of legislative drafting, let alone its contents and purpose.