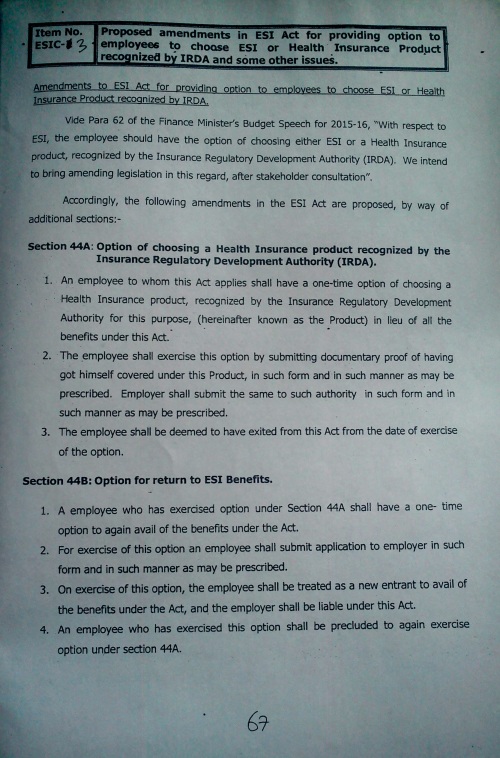

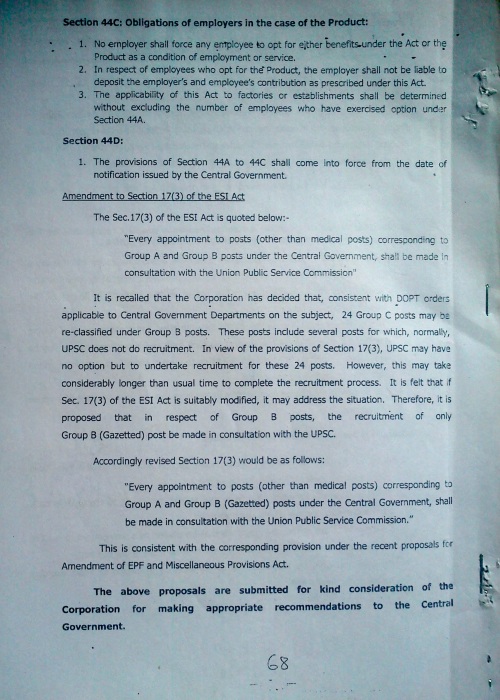

The following was the Agenda Item No. 3 placed before the meeting of the apex body of the ESI Corporation on 07.04.2015, proposing to amend Sec. 44 of the ESI Act, 1948:

The Agenda

The opening paragraph of the Agenda item says that the proposal to amend Art. 44 was born out of the need to fulfil the commitment made by the Hon’ble Finance Minister in Para 62 of his budget speech on 28.02.2015.

====

Paragraphs 61 and 62 of the Budget speech are re-produced here for easy reference of the readers:

61. Madam Speaker, the situation with regard to the dormant Employees Provident Fund (EPF) accounts and the claim ratios of ESIs is too well known to be repeated here. It has been remarked that both EPF and ESI have hostages, rather than clients. Further, the low paid worker suffers deductions greater than the better paid workers, in percentage terms.

62. With respect to the Employees Provident Fund (EPF), the employee needs to be provided two options. Firstly, the employee may opt for EPF or the New Pension Scheme (NPS). Secondly, for employees below a certain threshold of monthly income, contribution to EPF should be optional, without affecting or reducing the employer’s contribution. With respect to ESI, the employee should have the option of choosing either ESI or a Health Insurance product, recognized by the Insurance Regulatory Development Authority (IRDA). We intend to bring amending legislation in this regard, afterstakeholder consultation.”

====

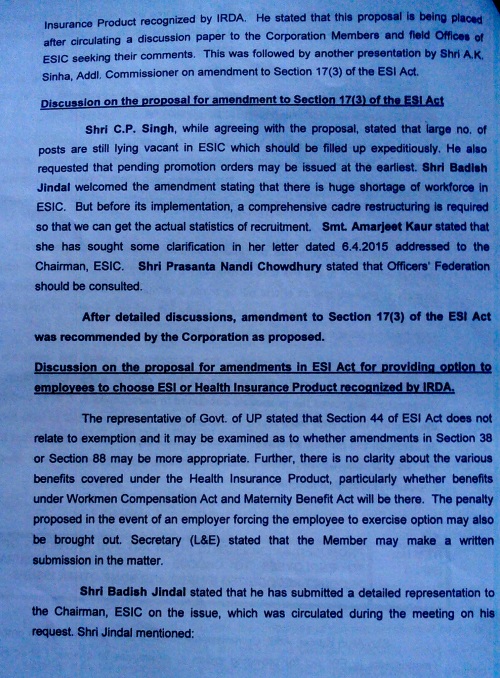

Fortunately for the insured population, the members of the ESI Corporation spoke very well during the meeting on 07.04.2015 against the Agenda Item that proposed to amend Sec. 44 of the Act that the Government had deferred the issue. The observations of the members of the ESIC as found recored in the Minutes of the meeting dated 07.04.2015 are given hereunder:

The Minutes

Dear Readers,

The ‘power’ of the middlemen of the rich to manipulate the politicians in power to amend an important social security enactment, just through personal contacts, becomes evident from the insertion of the word ‘hostages’ in the Budget Speech of the Government of India.

The alertness of the Members of the ESI Corporation on 07.04.2015 saved the nation that day.

But, grapevine has it that the proposal placed from the above on 07.04.2015 for amending Sec. 44 has not been dropped but is being pursued by various vested interests which are after big money.

Let the representative of the employees who are members of the ESI Corporation continue to exercise the same vigil !

The ESIC would work wonders, when run corruption-free. It has worked wonders in every pocket that had been run corruption-free. Let it not be run down by the politicians and power-brokers who do not care for the future of the nation but only about their present and go with their hidden agenda.

Let us prove that Robert Owen, Sir William Beveridge and Prof. B.P. Adharkar have not toiled in vain!

=====================================================

N.B:

The following additional information is given for easy reference to recall the facts which are relevant to this issue:

The fact that the ESIC was not holding anyone as hostage had been brought out in the following post:

https://flourishingesic.info/2015/03/15/sorry-no-hostages-there-mr-finance-minister/

The fact is that the ESIC is the best bet to provide security net to the people and the details in this regard with reference to international experience and national level instances were brought out in the following post:

https://flourishingesic.info/2015/03/07/run-the-esic-corruption-free-do-not-run-down-the-esic/

Inviting private players to meddle with social security network was nothing but abdication of responsibility of the government, and the facts in this regard had been brought out in the following post:

The sustained campaign by some middlemen to dilute the ESI Scheme so that the private players could enter the field and loot the people had been highlighted in the following posts:

https://flourishingesic.info/2015/04/18/the-extent-of-confiscation-around-the-world/

It was, thereafter, decided to trace the origin of the term ‘hostages’ used by the Finance Minister in his Budget Speech to use it as an alibi to run down the ESI Scheme and to amend the ESI Act to allow the private money-bags to enter the field of social security to make money for themselves and share a portion of it with the politicians who would help them.

https://flourishingesic.info/2015/07/08/healthcare-mr-jaitely-leads-the-nation-to-peril/

The fact that the word ‘hostages’ had been used by the Finance Minister in his budget speech, in a mysterious manner, without any supporting documents had been brought to the notice of the readers in the following post;

https://flourishingesic.info/2015/06/10/hostages-accusation-against-esic-epfo-without-documents/