05.04.2017

To

The CPIO (Labour Law Reforms),

Ministry of Labour & Employment,

New Delhi – 110001

| Sub: | Application under RTI Act – Draft Labour Code on Social Security & Welfare – copies of Rules, Regulatios and Schemes – requested. |

| Ref: | Memo No. No. Z-13025/ 13 /2015-LRC dated 16.03.2017 of the Ministry of Labour & Employment. |

Sir,

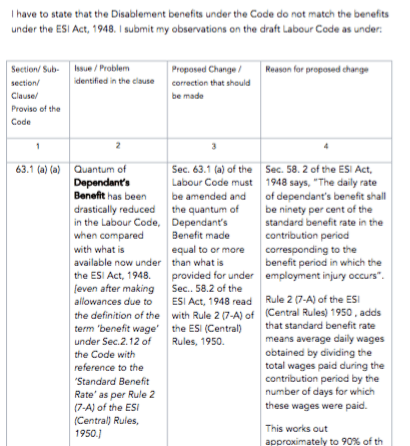

I invite your kind attention to the reference cited in which the Draft Labour Code on Social Security & Welfare was put on public domain on 16.03.2017, in the website of the Ministry of Labour and Employment, Government of India, New Delhi. The Draft Labour Code published is not an all-inclusive document and there are many grey areas. As the nature and the quantum of various benefits (except the Disablement Benefits and Dependants Benefits) have not been specified in the Code/ Act itself, the relevant subordinate legislations (the Schemes, Rules and Regulations including licenses and essential formats) should be put in the public domain along with the Code. But, it has not been done so.

- I, therefore, request you to kindly furnish the following information under Sec. 6 of the Right to Information Act, 2005 or put them in public domain in the website of the Ministry along with the Draft Labour Code concerned.

- Kindly supply the copies of the format of the proposed License (containing the Terms and conditions imposed by the Government on the agencies) referred to in Sec. 88 and 89 of the said Draft Labour Code on Social Security & Welfare;

- Kindly supply the copies of the proposesd Regulations and the Schemes referred to in Sec. 24 of the said Draft Labour Code on Social Security & Welfare.

- I have to state that although it is not necessary to provide, the reason why a citizen asks for certain information as per the RTI Act, 2995, I feel that the facts narrated in the Appendix would facilitate the authorities to supply the information requested for besides highlighting the extent of public interest involved in making the contents of the aforesaid documents public.

- I send herewith Postal Order for Rs. 10 being the fee payable under the RTI Act, drawn in favour of the PAO(MS), Ministry of Labour & Employment, New Delhi.

Yours faithfully,

Encl: Appendix and Postal Order

===========================================================================

Appendix

Facts that necessitate seeking information regarding the proposed Subordinate Legislations, the Rules, the Regulations (including the license formats) and the Schemes

The Act of 1948 Vs. The Code of 2017:

1. When the ESI Act was enacted in the year 1948, it was venturing into a new area. So, the Act itself assured the people, through its Sec. 46, of the five major kinds of benefits and also the quantum of those benefits that would be made available through the enactment. It was later, in the year 1989, that the quantum of benefits, quantum of contribution and wage limit were taken to the Rules to facilitate easy revisions. When, the present piece of legislation, the proposed Labour Code, is intended to replace the existing social security machinery, people become apprehensive and want to know whether they stand to gain or lose by that new system.

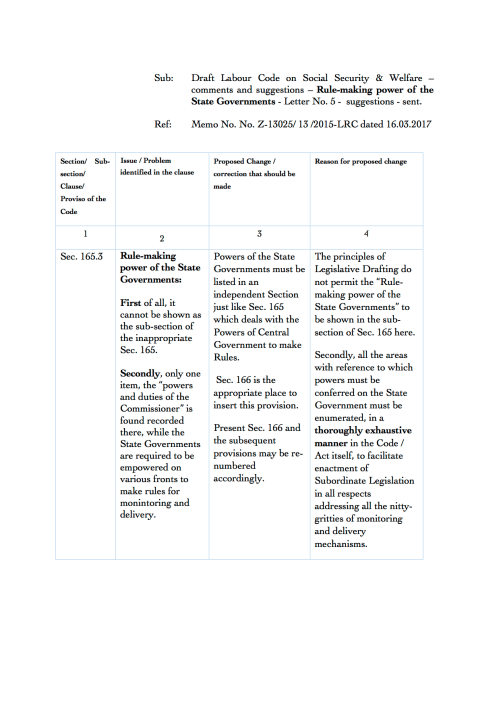

2. The Executive, therefore, cannot bring in a truncated version of the proposed system in the form of Code and ask the MPs to vote. But, that, exactly, is what the bureaucracy has, exactly, done through this Draft Labour Code. Sec. 24.5 of the Code enumerates the nomenclature of the benefits that would be made available to the workforce. But, the quantum of benefits and the nature of machinery through which such benefits would be provided have not been made known. These issues have been kept reserved for the Executive to make Subordinate Legislations later.

3. But, in all probability, the draft subordinate legislations, (a) the Rules, (b) the Regulations including the termns of conditions of license and (c) the Schemes would, already, have been prepared and kept in the Ministry. The non-publication of those drafts along with the Draft Code, for public debate gives the bona fide impression that the forces which are behind this move, want to hide many vital aspects of the proposed social security system away from public knowledge until they get the Code passed by the Parliament and acquire power to do whatever they want through Subordinate Legislation. Or, i.e., if they have not yet prepared those draft Rules, draft Regulations, draft Schemes and draft licences, it would imply that these forces want to destabilise the present social security structure and bring in something which is not known even to themselves.

A service organisation is converted into business organisation:

4. I submit that the ESI Corporation is not a business organisation preparing profit and loss account. It is a service organisation preparing income and expenditure statement. But, the very wordings of Sections 2.58, 2.68, 2.101, 2.109, 2.123 and Sec. 88. show that the intention behind the Code is to handover the operative side of the scheme to private businessmen who enter into the field with profit motive.

5. Sec. 88.1 of the Code says that the “Director General may, by granting a License under this Code, permit any organization or person to act as an intermediate agency for all or any of the purposes” mentioned against each of the six agencies enumerated therein. Those agencies are: (a) Fund Manager Agency, (b) Point of Presence Agency, (c) Service Delivery Agency, (d) Benefit Disbursement Agency, (e) Record Keeping Agency and (f) Facilitation Agencies.

6. Sec, 88.3 of the Code says that “an intermediate agency shall function in accordance with the terms of its License and the Regulations”. Sec. 88.4 implies that the terms and conditions of such a license will be “in accordance with the provisions of this Code and the Regulations”. Sec. 88. 5 says that the application for such a license will be in a specified form.

7. So, the public must be informed of the concept and intricacies of these Agencies-system, and the contents of the Schemes proposed on all the Social Security benefitis. Because, that alone would provide a holistic view of the ‘reforms’ proposed. Because, that alone would make the people know about the real and consequential effect of the proposed Code.

“Obamacare” was allowed threadbare discussion for three years:

8. There cannot be meaningful public debate when all the draft subordinate legislations are not placed before the public. In the USA, when the Obamacare was introdued in 2009 and made law on 23.03.2010, through the Patient Protection and Affordable Care Act (ACA), there had been extensive public debate over it for more than three years (from 2009 to 2012) before it was enforced after the Supreme Court upheld it on June 28, 2012.

9. It is essential for the Executive to place in public domain a comprehensive Bill covering all aspects of the subject-matter, including the proposed Schemes, Rules (that would be framed by the Government) and the tentative Regulations (that would be framed by the National Council) with reference to the aforesaid Sec. 24.5 to explain the quantum of benefits made available to the workforce and the manner in which the delivery machinery would function.

10. Please therefore, supply the information requested for in Para 2 of the Applicaton either individually to me or by hosting all of them in the website of the Ministry.

11. In the context, I think it appropriate to bring on record the observations of C.K. Allen, in his book Law and Order, (1945). He agrees with the universal fact that Subordinate legislations provide for convenience, flexibility and efficiency with respect to the delegation of such powers. But, he says, that all these arguments regarding convenience, flexibility and efficiency are “sound arguments for delegation within due limits, the kind, in fact, which has always been recognized as a practical and necessary part of our governmental system. But they become unsound and dangerous if they are used to justify the indefinite extension of executive powers. Speed and efficiency may be bought at too high a price, and indeed we should have learned from many examples that the State which makes efficiency its highest god is very apt to become an all-devouring monster.

Apparent defects indicative of unseemly hurry:

12. Apparent defects of various kinds in numerous places in the Bill show unseemly hurry on the part of the authorities to bring out this Draft Code. Besides, the fundamental flaw with this Draft Labour Code is that the Government of India, is trying to make provisions for “private assistance” and absolve itself of its Constitutional responsibility of providing “public assistance” as mandated as per Art. 41 of the Constitution of India.

13. ESI Act is a great provision aimed at rendering distributive justice to the people of the nation. But, that is attempted to be belittled by this Labour Code. Hon’ble High Court of Madras has, in ESIC Vs. S. Savithri 2003 (3) LLJ 250, observed that “The Scheme of the (ESI) Act, Rules and Regulations spelled out that the insurance covered under the Act is distinct and differs from the contract of insurance in general….The Division Bench of the Madras High Court observed that the Act in fact tries to attain the goal of socio-economic justice enshrined in the Directive Principles of State Policy”.

14. Even The Hindu conceded editorially on 01.01.2005 that “The package (of benefits provided by the ESIC) can rarely be matched by private employers on their own because of the heavy costs involved – not to mention the disinclination among employers, with honorable exceptions, to operate health care systems for their workforce”

Fundamental Principles laid down by Prof. Adharkar:

15. Prof.Adharkar, the Father of Social Security in India, had laid down the following as Fundamental Principles, when a scheme on social security is introduced;

(a). The proposed scheme must not be too ambitious in the beginning;

(b). It must be simple, clear and straightforward,

(c). It must be financially sound, economical in working and actuarially balanced;

(d). It must minimize disputes and litigation;

(e). It must be workable in the peculiar circumstances of Indian labour and industry;

But, the proposed Labour Code ignores all these principles, which necessitate one to go through the proposed Subordinate Legislations also before arriving at an opinion whether the proposed changes would be an all-encampassing one, workable really and beneficial to the workforce.

ESI Act itself has the potential for coverage of even homeworkers:

16. The importance of the ESI Scheme to a nation would become evident from this observation. The Act provides security-net to the working population in the organised sector and its long-term goal, as spelt out in Sec. 1 (5) of the Act is to extend the security-net not only to the factories but also to the establishments, industrial, commercial, agricultural or otherwise.

Public Interest and the RTI Act:

17. I submit that I am asking only for the information to which I am entitle to ask as a citizen of the nation. This information asked for by me in para 2 supra is required in public interest. Hon’ble High Court of Madras has observed, “Public Interest means an act beneficial to the general public. Means of concern or advantage to the public, should be the test. Public interest in relation to public administration, includes honest discharge of services of those engaged in public duty. To ensure proper discharge of public functions and the duties, and for the purpose of maintaining transparency, it is always open to a person interested to seek for information under the Right to Information Act, 2005” (The Registrar, Thiyagarajar College of Engineering, Madurai Vs. The Registrar, Tamilnadu Information Commission – 30.04.2013).